Why The 1% Don't Get It

The existing financial system works great for the affluent; of course they don't understand crypto.

PREMISE OF THE PIECE

Most still don’t understand why crypto exists or what its potential could be despite crypto’s meteoric rise since the launch of Bitcoin in 2009. In my experience the issue is most acute amongst the highly educated and relatively affluent. Unique compared to other demographics, the affluent struggle to appreciate how the existing financial system is deeply flawed and fail to grasp what value crypto technology could provide. If a system is working great for a certain group of people there’s little reason for them to understand alternatives, much less seek them out.

This post offers a simple introduction to crypto and explain at a (very) high level the “Why?” of the emerging technology. While the piece may not convince you that crypto is nothing more than a bubble, even the most ardent crypto skeptic should come away with a greater appreciation of cryptocurrency technology and potential future applications.

If you need further convincing, trust me when I say crypto is the most profound innovation since the internet. It behooves everyone to at least be familiar with why crypto adoption is happening, especially the affluent. After all, you don’t want to be left behind, do you? :-)

INTRODUCTION: WHAT IS CRYPTOCURRENCY?

Cryptocurrency is a specific application of blockchain technology. Blockchain technology can be thought of as a digital ledger. A “block” is a collection of data, usually transactions in the case of cryptocurrencies. At specified intervals depending on the design of the system, each block is added to the digital ledger, i.e. the blockchain. A blockchain is literally a “chain of blocks” that keeps a recorded history of transactions linearly through time.

Cryptocurrencies are blockchains used to facilitate the exchange of value. Bitcoin is the first and most famous cryptocurrency. At its simplest, the Bitcoin blockchain is a digital ledger used to track who owns how many bitcoins. (Note capital “B” Bitcoin is used to refer to the Bitcoin Network; lowercase “b” bitcoin is used to refer to the cryptocurrency). Bitcoin is programmed such that only 21 million bitcoins will ever exist and is commonly thought of as a digital store-of-value or “digital gold,” the lindy store-of-value asset.

Bitcoin’s most profound innovation is its consensus mechanism - Proof of Work (PoW). Highly simplified, PoW consensus is a process in which a network of computers compete to earn the right to verify transactions to the blockchain. Under PoW, each computer verifying transactions is called a “miner.” In return for their effort, miners are rewarded the cryptocurrency of the network, or bitcoin in the case of the Bitcoin Network. As an open-source protocol, anyone can add their computer to the Bitcoin Network and verify the veracity of Bitcoin’s transactions since its launch in 2009.

Pretty simple so far. But you’re probably thinking “So what?”

Here’s the “So what?”: PoW’s design enables the growth of a huge network of independent actors. As the price of bitcoin goes up as more capital enters the network, more miners are incentivized to join the network. As more miners join the network, there is more trust in the network, more capital enters the network, and so on and so forth in a virtuous cycle.

This elegant incentive mechanism has created a huge network of independently-operated computers dedicated to preserving a simple ledger of bitcoin transactions. Since launching in 2009, the Bitcoin Network has grown massively, with more than 100 million individual bitcoin owners1, an estimated 1 million miners2, and a market cap of ~$400 billion, making it the 17th largest asset in the world3. Bitcoin’s adoption has been meteoric, rivaling that of the early days of the internet.

Let’s take a step back here and reflect on what is happening.

Completely organically, over one hundred million economic actors voluntarily chose to join the Bitcoin Network. No government, no coercion, no central authority at all. Using nothing but computer code and simple incentives, Bitcoin has succeeded in enabling a respectably-sized country of individuals all over the world to cooperate and coordinate with one another to willingly exchange value.

It’s pretty incredible when you think about it.

The #2 cryptocurrency by market cap, Ethereum, builds on Bitcoin’s consensus innovation but introduces programmability. Ethereum is a cryptocurrency with smart contract functionality. Smart contracts on Ethereum enable users to enter agreements via the internet and enforced by code beyond Bitcoin’s sole use case of managing the exchange of bitcoins. For example, on Ethereum, you can borrow money on lending platform Aave, you can swap one asset to another using automated market-maker Uniswap, or you can buy a piece of art or a profile picture on NFT platform OpenSea.

While it’s early, with Ethereum you can see the potential for an internet-based global financial system; a system without borders, a system accessible to anyone with an internet connection, and a system without rent-seeking third parties extracting a pound of flesh on every transaction. Remarkably, Ethereum has taken off even faster than Bitcoin, with nearly 2x the wallets despite being more than six years younger (Ethereum launched in 2015).

Hopefully by now you’re beginning to see the significance of crypto and some potential use cases such as exchange of value.

To further emphasize several key points, as decentralized public blockchains Bitcoin and Ethereum are:

Trustless. They do not require a centralized authority to coordinate between two or more disparate parties.

Censorship-resistant. Hundreds of thousands of economic actors all over the world independently maintain the networks. Therefore, it is virtually impossible for corporations, individuals, and governments to block access to the protocols to anyone with an internet connection.

Secure. In the case of Bitcoin, to attack the protocol it would require controlling 51% of the network, which I estimate would require at a minimum ~$8 billion of semiconductors before considering many billions more in capital and years of effort for the necessary infrastructure investment.4

In a sentence, Bitcoin and Ethereum are public blockchains that anyone in the world can access without gatekeepers and without fear of a hostile actor appropriating your property.

This is a big deal! Before crypto, humans needed a government to enforce such a large and global system.

For the affluent amongst us, there is a good chance you may understand the technology at a high level and recognize that many people are choosing to participate in it. But you still may be highly skeptical. If this is you, you are likely thinking “The current system works totally fine. What’s the freaking point?”

Let’s explore the current paradigm to better understand how cryptocurrency could provide an interesting alternative to the existing financial system, starting with the money.

FUNDAMENTAL FLAWS WITH THE FIAT SYSTEM

Practically speaking, the current fiat-based monetary system centered around the US dollar as global reserve currency and perpetual deficit spending by Western governments is unsustainable. Some other alternative will emerge within our lifetimes and deficit spending government currencies including the dollar will devalue significantly over the coming decades. Given this eventuality, it is prudent for individuals to protect themselves from monetary debasement. Cryptocurrencies and specifically bitcoin present an interesting solution to this predicament.

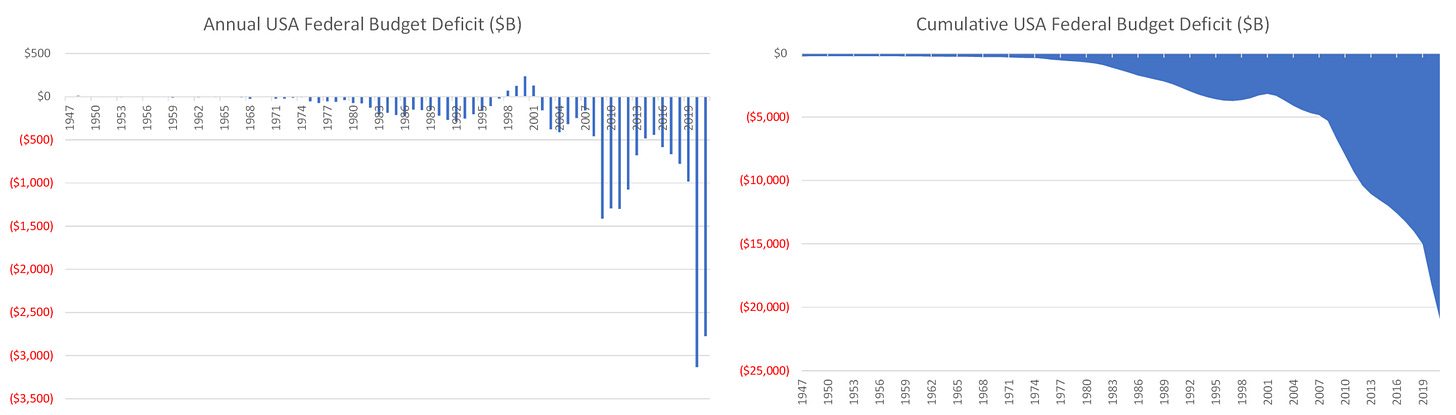

The US Federal Government’s Budget has been deeply negative since the Nixon Administration formally ended the Bretton Woods system that kept the US Dollar loosely pegged to gold. The petrodollar system, which emerged in the 70’s, made the US Dollar the effective global reserve currency. As the global reserve currency there is more demand for the dollar than can be justified based on the size of the US economy alone, enabling the US to consume more than it makes without massively devaluing the dollar. The US has taken advantage of this arrangement. The US’ cumulative deficit stands at more than $20 trillion. The trend is literally #UpOnly.

The US Deficit is #UpOnly:

The United States Treasury, responsible for financing the Federal Government, sells Treasury bonds to cover Federal Government spending beyond its means. For most of the petrodollar system’s history, foreign government such as China and Japan as well as individuals and investment institutions were reliable demand for Treasury bonds. Beginning in 2009 US government spending started blowing out during the Global Financial Crisis (GFC). Since then, foreign demand for US government bonds has been shrinking. The problem further accelerated during the COVID crisis as shown in the chart below. Other countries increasingly do not want to enable profligate spending by the US government.

Treasury Purchases by Country: The largest buyers during GFC were net sellers during COVID

To fill the void left by foreign buyers leaving the market for US treasury bonds, the Federal Reserve, the US’ Central Bank, began buying bond issuances from the Treasury in a process known as “Quantitative Easing” (QE). QE can be thought of as the government printing money to finance itself rather than collecting more taxes or cutting spending. Money printing via QE has proven itself to be the more popular solution to financing government spending than the alternative as shown by the Greece austerity measures taken post the GFC.

For visual learners, here’s a visual representation of QE:

The Fed as the largest buyer of Treasury securities kept interest rates very low following the GFC, enabling the government to finance itself at favorable interest rates (i.e. cheap debt). On the other hand, with cheap financing the US government had no incentive to fix the structural issues with the Federal government’s budget. Due to generous entitlement programs like Social Security and Medicare, the US government’s outlays are programmed to grow faster than tax revenues for decades as the US’ elderly population outgrows its working-age population, and thus tax base.

Over the last decade, the Federal Reserve became the largest owner of US Treasury Bonds, accumulating roughly 40% of all long-dated treasury securities. More recently, the Fed has been forced to reverse its QE policy to reign in inflation caused by the extreme money printing seen during the COVID crisis, when the US government grew the money supply by ~40%. The process of “Quantitative Tightening” (QT) is the reverse of QE: the Fed stops buying treasuries and the money supply shrinks. The Fed began signaling to the market in November 2021 that QT was coming, leading to treasury yields increasing significantly and risk assets such as crypto selling off hard.

The US government and the Federal Reserve face a serious issue from here. If the Fed relies on the free market to finance the US Federal government’s deficits, there is a risk that interest rates on the government’s debt will be far higher than those enjoyed by the US for most of the last decade. Remember, the Fed was the buyer of roughly 40% of the Federal government’s outstanding long duration debt. At least 40% of the demand for treasury issuance has to be replaced and one of the largest sources of demand - foreign governments - does not want to finance US government spending. These are huge demand holes that need to be filled.

Higher rates would have a double negative impact on the government’s ability to finance projected spending. Firstly, higher interest expense results in a larger government deficit (and thus more bond issuance). Secondly and more perniciously, higher interest rates result in lower tax collections as the economy slows down due to higher cost of debt. A slowing economy is a major no-no for a debt driven society with ever-increasing liabilities to its citizens. At a minimum, the Federal government will have to finance $1.5-2.0 trillion in deficits per year through 2032. At higher interest rates and lower economic growth, the problem gets much more severe.

The US has a huge deficit problem; at higher interest rates and slower economic growth, the problem only gets worse.

In essence, because there is an enormous amount of debt that needs to be issued over the coming decade and the US government cannot afford interest rates going too high, it appears highly likely that the Federal Reserve will need to re-engage QE at some point over the coming years, potentially soon if the US economy enters an economic contraction. QE means perpetual money printing and debasement of the dollar.

This system of perpetual US government deficits has come with meaningful cost for the average American. With the government controlling an increasing amount of US spending power, politically-favored industries such as healthcare, education, and housing are consuming an increasing share of the average American’s wallet:

Further, asset prices and eroding purchasing power for the middle class have resulted in an increasing share of wealth enjoyed by the richest Americans. As the average Joe competes over a shrinking pie there is little incentive to change the existing system for those that run the country: the government and the rich.

While the US’ fiscal situation is troubling, many foreign countries situations are even worse.

Japan offers a preview of what the US’ fiscal situation may look like in the not too distant future. The Japanese Central Bank owns nearly 50% of its own bonds. The Japanese government appears determined to find out how much of its economy it can finance before holders of its currency figure out the yen is not scarce at all and essentially worthless.

Developing countries such as Turkey, Argentina, and Venezuela which do not benefit from robust economies or reserve currency status and spend beyond their means suffer from shockingly high inflation and perpetual currency crises, making their citizens worse off year after year.

For billions of individuals subject to irresponsible government monetary policy, Bitcoin offers a potentially compelling alternative to the increasingly unstable fiat-based system.

Most saliently, Bitcoin offers certainty of scarcity. Bitcoin is programmed such that only 21 million coins will ever exist. Because the blockchain is decentralized, no group of people can change the amount of bitcoins, no government can debase an individual’s purchasing power in bitcoin terms. Given a choice, it’s easy to see why someone would choose to hold a provably scarce digital asset like bitcoin vs. their local currency that is devaluing high double- or even triple-digits every year.

In fact, crypto adoption has been strongest in developing countries. According to Statista, Nigeria, Vietnam, and the Philippines are the top three countries by crypto adoption, with a remarkable 32% of Nigerians having used or owned cryptocurrencies. Nigeria’s reported inflation rate has ranged from 10-20% over the last decade. Said plainly, a Nigerian’s purchasing power is decreasing every year by 10-20%. Meanwhile, Bitcoin’s purchasing power over the last decade has increased by many thousands of percent. Which system would you prefer?

It’s clear individuals are choosing crypto. There also are increasing reasons to believe entire countries may be considering alternatives to traditional assets to protect their wealth in the not too distant future.

In February of this year, the United States cut cut off Russia’s access to the SWIFT system. The Society for Worldwide Interbank Financial Telecommunication is the global payments network that facilitates trade amongst international financial institutions. The US effectively cut Russia off from the main technology infrastructure for global trade. To further enhance pressure, this summer news broke that the European Union is exploring banning imports of gold to Russia.

Historically, the US-dominated Western financial system has been the most trusted due to relatively stable government and robust legal protections. Gold has been the gold-standard reserve asset: scarce and ostensibly no counterparty risk (gold can’t go bankrupt). Recent events highlight to the world the risks inherent in storing your wealth in systems controlled by Western democracies. Increasingly, major countries are seeking alternatives.

Bitcoin has several properties that make it an interesting alternative to traditional reserve assets such as paper currency, sovereign bonds, and gold.

Bitcoin is sovereign. There is no counterparty risk. The Bitcoin Network is a collective of 10’s of thousands of individuals running the network in dozens of countries around the world. All a country needs is a node and an internet connection and they can access their wealth immediately. A country does not need to fear a counterparty debasing the value of their assets like the US does every year as it grows the supply of dollars. A country does not need to fear a counterparty eliminating their access to their property as the US did by cutting Russia’s access off to the SWIFT system.

The current fiat-based paradigm is plagued by human fallibility. Mathematically, it appears the problem of perpetual monetary debasement is likely to get worse. As a result, individuals risk accelerating loss of real wealth. At the same time, countries are becoming more aware of the risks they are taking by participating in a US-controlled monetary regime. Cryptocurrency and specifically Bitcoin present an interesting and likely increasingly attractive alternative to the fiat-based system for individuals and countries alike.

Now that we understand the inherent unsustainability of the fiat-system and its money, let’s explore issues with the financial system that go largely unappreciated, especially by the affluent for whom the system works relatively (much) better.

FUNDAMENTAL FLAWS WITH THE FINANCIAL SYSTEM

Most can grasp the appeal of bitcoin and “digital gold” as general awareness around monetary debasement has increased in the wake of Quantitative Easing. Trying to explain the potential of Ethereum and decentralized finance (“DeFi”) as an alternative to the existing financial system is where the affluent really struggle to appreciate the technology’s potential. The existing system works well for most so what is there to improve?

The modern financial system has been designed around the idea of a trusted third party or parties. You keep your money and take out a mortgage with a bank like Chase. You keep your stocks with an online brokerage like Schwab. You pay for groceries and other essentials with a credit card from Mastercard. You pay bills or your friends with financial applications like Cash App or Venmo. You send money to your loved ones overseas with a remittance provider like Western Union. It all works generally smoothly.

Have you ever considered what you are giving up with these arrangements?

Turns out it’s a lot.

Think about what it takes to even access these services. You’re required to provide every detail about yourself. Need to wait days for approval. If you have bad credit they can deny you. If you’re not a US citizen good luck even getting started. Assuming you’re able to sign up, you likely can only access the services during certain, narrow hours as in the case of banks (9-5, forget about weekends of holidays) or brokerages (market hours).

Then there’s the friction. Want to move? Think about how painful it is to switch brokerages. If you’re leaving the country, your bank or broker will very likely treat you like a terrorist (to be clear it’s not their fault as they’re required to by the government). If you’re a merchant, it can take days or even months to finally receive the funds of a transaction. Not ideal if you’re a small outfit running tight on cash.

Last but not least there’s the cost. Banks make a 2-3% spread for the privilege of holding your money. They pay you 0% for your money then lend it out at 3, 4, or even 5%. Nice. Brokers like Schwab make a killing on the mutual funds they sell you or the securities you keep with them. Credit card issuers like Capital One and payment processors like Visa take 2-3% of any debit or credit card transaction you make. Remittance providers like Western Union take a remarkable 5%+ for the privilege of sending money outside the US’ borders.

Why does it all cost so much? A combination of rent-seeking and trust. Banks benefit from the FDIC insurance subsidy essentially ensuring that they will be the primary place to keep your cash. Payment processors with the help of the banks and the government have monopolized the technology rails we use to move money around. Various government regulations and technology standards have made it complicated and expensive to send money between countries, especially small dollar amounts. We trust these systems mostly out of habit without ever questioning the necessity or cost of such arrangements.

What if we could create a system that had all the trust of the existing system while doing away with the rent-seeking?

With Ethereum and other smart-contract enabled blockchains, we can.

Today you can store your wealth in a digital wallet on the Ethereum blockchain accessible by you anywhere in the world at any time of day. Absolutely no friction by banker hours, borders, or other inconveniences. All you need is an internet connection and a browser like Chrome.

Want to earn some yield on your cash? Head to Aave, a decentralized lending marketplace, and deposit some funds. Aave is currently paying out 1-2% on stablecoins (i.e. digital dollars) while making a razor-thin 10-15% of the revenue earned by depositors. Good luck to banks having to compete with that in the future.

Want to swap some of your cash for token of another protocol? Head to Uniswap to buy the token of a promising up and coming project.

Want to take out a loan? Head to MakerDAO, deposit your Ethereum, and take out some stablecoins (i.e. digital dollars). You may be surprised to learn individuals are already borrowing against their crypto assets completely permissionlessly on the internet and buying real-world assets like pianos and even homes.

Want to pay a merchant for a cup of coffee? Use your Phantom wallet on the Solana blockchain with USDC stablecoin to pay your local barista in seconds for less than a penny per transaction. No 3% fee to the credit card company. No days or even weeks of waiting for the funds to arrive for merchants.

In all of the above examples, you can:

Access them in seconds, anywhere in the world. All you need is an internet connection, a browser like Chrome, and a MetaMask wallet to use the applications. No need to share your identity or wait for a human to approve you. The service is available to you in seconds.

Instantly settle. No waiting for the bank to approve your loan or for a stock trade to settle. The funds are available to you within minutes.

Do so cheaply. Transactions currently cost $1-2 on Ethereum, making payments above $100 competitive with credit cards. Comparable smart contract platforms such as Solana or Polygon are even cheaper and faster costing cents per transaction.

In a sentence: A blockchain-based system is far more accessible with minimal friction at far less cost. More access, less friction, and less cost are generally a powerful combination in technology, as the internet has shown to traditional industries like advertising and media in the case of Google, retail in the case of Amazon, or telephones in the case of Apple.

Before we go assuming a utopia free of legacy financial system morass, it’s important to be realistic: the technology has a long ways to go before it’s ready for prime time. The current user experience is abysmal. It remains nearly impossible to use crypto in the real world. The regulatory treatment of crypto remains highly ambiguous.

The biggest challenge facing crypto may not even be technology but consumer behavior: The transition from using third party services to manage your wealth to self custodying is a huge one. As AOL’s 1.5 million paying customers will tell you, consumer behavior is super sticky. I wouldn’t be expecting Baby Boomers to jump headfirst into a public blockchain-based financial system.

But like the early days of the internet, crypto represents a Zero to One technology leap vs. the existing financial system. The word is getting out: thousands of software developers are pouring into the space to take advantage of this potentially once-in-a-generation opportunity:

The thousands of entrepreneurs and growing focusing on crypto will figure out crypto’s kinks. As the wrinkles are ironed out, individuals are likely to increasingly continue opting into the crypto financial system and cut out the middlemen that dominate the existing financial system.

CONCLUSION

The current fiat-based system generally works well. Billions of individuals are able to exchange goods and services every day. The system is also sticky. Habit and regulation such as governments mandating that taxes be paid in local currency make it extremely unlikely an alternative financial system will emerge overnight.

What is more likely to happen is individuals continue to opt into the new internet-based economy and digital assets such as bitcoin and Ethereum take an increasing share of global net worth. A sovereign, internet-based financial system offers too many benefits compared to the existing system that it’s unlikely we don’t continue to see crypto adoption for many years to come.

Plus there are speculative cycles. The crypto asset class is the best performing of all time. Bitcoin is up 230% annually over the last decade. Ethereum is up >2,000x since its initial coin offering in 2014. But the shift of wealth from the traditional fiat-based financial system remains early. Total crypto market cap of $0.9 trillion compares to global assets of roughly $500 trillion. It’s not a stretch to think the world may collectively store 1 to 10% or more of its wealth in crypto assets over the long-term, particularly as the world becomes increasingly digital. Future crypto cycles will continue to push the technology and draw in a new crop of risk-seeking adventurers (example: me, class of 2021).

So even if the existing system works well for you and you’re a crypto skeptic, it behooves you to understand and appreciate crypto as a technology wave potentially bigger than the internet. Crypto is likely only to get stronger over the coming decades.

FOR FURTHER READING:

Economist Saifedean Ammous’ “The Fiat Standard” for a comprehensive review of the flaws inherent in a fiat-based, debt-driven economy.

Macro commentator Lyn Alden’s piece “What is Money, Anyway?” for a review of various currency regimes over history.

Placeholder Ventures’ Crypto Investment Thesis.

https://www.buybitcoinworldwide.com/how-many-bitcoin-users/

https://capitalcounselor.com/how-many-bitcoins-are-there/#:~:text=There%20are%20approximately%201%2C000%2C000%20Bitcoin,minutes%20to%20mine%20a%20bitcoin.

https://companiesmarketcap.com/assets-by-market-cap/

Based on Bitcoin network’s current 200 exahash equivalent to 2M S19 miners at $4k / miner cost.

Already bullish on crypto's future, but man this article takes it to another level🔥