Optimistic Arbitrum

Exploring Arbitrum and its potential to emerge as a major smart contract platform

Crypto protocols that performed well during the last bull run had a unique ability to attract users, capital, and attention.

Arbitrum, the top Ethereum Layer 2 (L2), and its ecosystem have the potential to attract significant users, capital, and attention over the coming years.

In a crowded smart contract platform space, Arbitrum has three clear tailwinds working for it:

Ethereum Halo Effect: True L2s like Arbi will benefit from ETH’s dominance;

Favorable Relative Users and TVL: Arbitrum is smol; and

Novel Ecosystem: Arbitrum is full of innovative projects.

This piece briefly introduces Arbitrum before covering each tailwind working for the promising smart contract platform.

TLDR: I’m Optimistic Arbitrum.

Arbitrum and Layer 2 Season

The Alt L1 thesis is tired. According to CoinGecko there are 186 smart contract platforms. How many times have you heard the pitch “faster, cheaper, and more scalable than Ethereum?” How many ecosystem funds have been launched? What are the odds we are going to RUN-IT-BACK-TURBO with “the next Solana” next cycle?

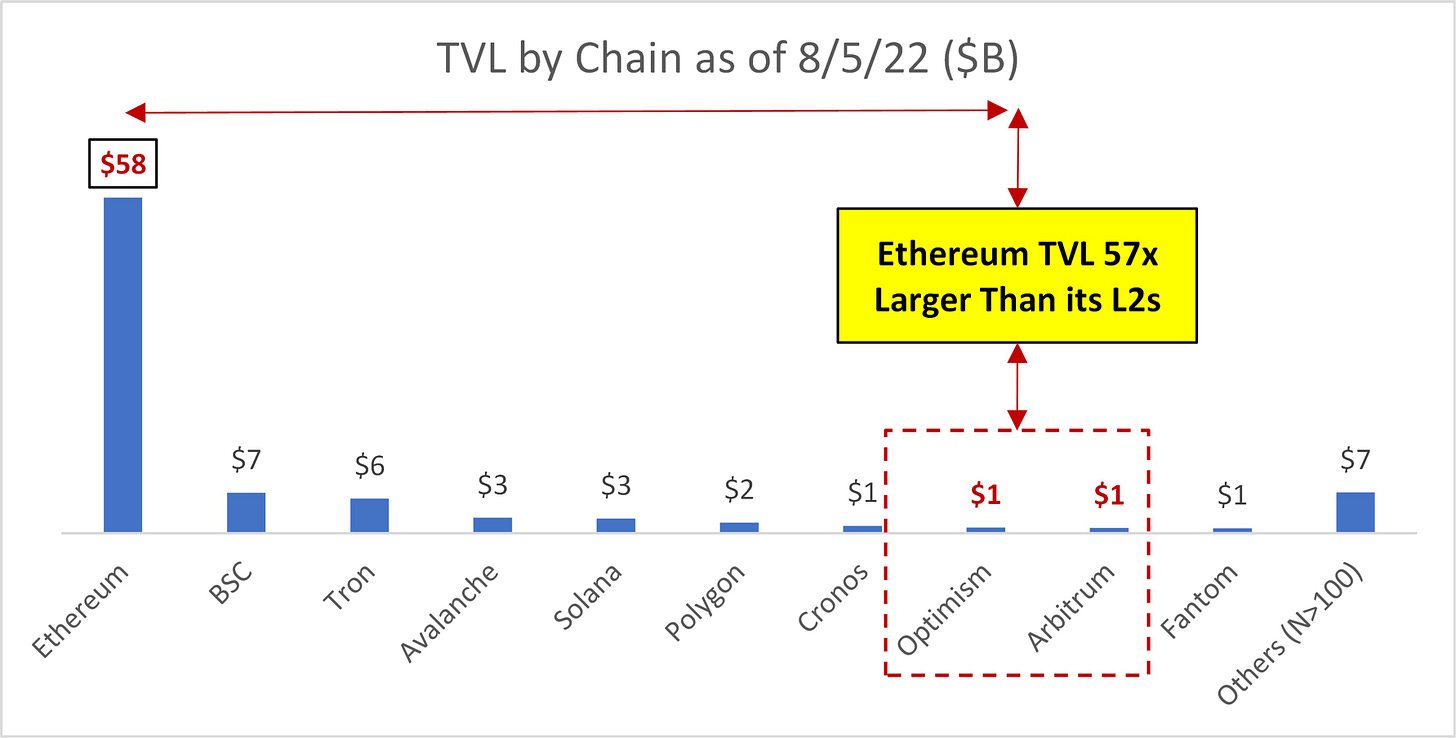

The data suggests Ethereum and the Ethereum-Virtual-Machine (EVM) are emerging as the preferred standard for public blockchains. Ethereum hosts around 60% of all public blockchain total value locked (TVL) while ~90% of all crypto TVL is EVM-compatible. Further, Ethereum dominates the fee market for smart contract platforms, representing well over 90% of the total market for blockspace by revenue.

While early days, Ethereum appears to be emerging as the Apple of smart contract platforms: the dominant player in both innovation and value creation. Picking the Android of smart contract platforms to Ethereum’s Apple is going to be an exceptionally difficult task over the coming years.

Good luck to the VCs!

On the other hand, the Ethereum Layer 2 (L2) narrative is fresh and far easier to get your arms around.

Crypto’s most popular smart contract platform - Ethereum - is maxed out at between 1-1.2 million transactions per day and needs L2s to grow. L2s as a theme are near close to a certainty.

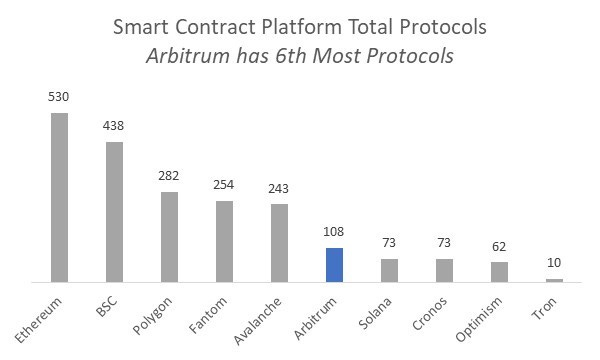

Ethereum L2 scaling solutions are nascent. According to L2BEAT there are 22, only four that have TVL greater than $100 million. The only one of the four without a token also happens to have the most protocols and the second most TVL.

Which L2 am I referring to? None other than Arbitrum.

Arbitrum is an Ethereum Virtual Machine (EVM)-compatible layer 2 (L2) rollup blockchain.

The chain uses Optimistic Rollup technology to scale Ethereum’s capacity from ~12-15 transactions per second (tps) to 40,000 tps. Transactions are also a fraction of the cost. An Ethereum transaction currently costs single-digit dollars to >$10 depending on utilization of the chain and the price of ETH. An Arbitrum transaction costs around $0.10.

The chain is run by New York-based Offchain Labs and opened to users August 2021.

Compared to other L2s like Optimism and Metis, Arbitrum has the second most TVL at $0.9 billion; it was recently surpassed by Optimism after the launch of its liquidity-incentive program. Arbitrum has the most protocols at 108, the sixth most of any smart contract platform despite being just one year old. Most impressive, this has been achieved without a token or an ecosystem fund.

Arbitrum’s growth-to-date has been entirely organic.

Arbitrum is set to release a major upgrade - Nitro - August 31st. Nitro sets the stage for the return of Arbitrum Odyssey. Arbitrum Odyssey is Arbitrum’s marketing campaign to encourage users to try out various protocols on the Arbitrum blockchain, in return for NFTs and potentially an airdrop (rumor). There is also the potential for an ecosystem-fund later this year or in 2023 to accelerate the liquidity, developer- and user-adoption of the chain.

Needless to say Arbitrum is off to a great start and its ecosystem is catalyst rich over the coming months.

But there’s more to the story.

The Ethereum Halo, the Relative Size of Arbitrum, and the Novel Ecosystem serve as three tailwinds for the smart contract platform over the coming years. Let’s explore these further as they’re important to understand.

Note much of the below is also highly relevant for Arbitrum peer Optimsim but for the purposes of this piece we have chosen to focus on Arbitrum.

(1) Ethereum Halo Effect

While there are plenty of chains that are cheap and fast, Arbitrum is unique as it is an Ethereum scaling solution and nothing more.

L2s like Arbitrum separate the execution and the security layer. The L2 executes transactions quickly and cheaply and then posts a batch of transactions to the Ethereum L1 for maximum decentralization and security.

Arbitrum’s native token is ETH and the L2 pays fees to the Ethereum L1.

Arbitrum is complementary to Ethereum; it offers scalability - faster and cheaper transactions - to ETH while in return paying fees for Ethereum’s best-in-class decentralization and security.

This is in stark contrast to other “Ethereum-scaling” solutions like Polygon.

Polygon, a prominent EVM-compatible smart contract platform, markets itself as an Ethereum scaling solution. However, Polygon has its own token and doesn’t pay gas fees to the Ethereum L1. Further, Polygon executes transactions and maintains state on its own servers.

The Ethereum L1 does not participate in Polygon’s activity. EVM-compatible chains like Polygon or Binance Smart Chain (BSC) are more appropriately thought of as competitors to Ethereum vs. Ethereum scaling solutions.

This distinction is important. True Ethereum-scaling solutions like Arbitrum share Ethereum’s mission to make Ethereum, the most decentralized and the most secure smart contract platform, the global public blockchain standard.

Because of Arbitrum’s complementary role in scaling Ethereum, the chain is more likely to benefit from Ethereum’s brand and scale compared to Ethereum competitors. Said differently, Arbitrum is more likely to attract liquidity and users from Ethereum’s huge ecosystem compared to alt L1s and sidechains which are competitors to Ethereum.

(2) Favorable Relative Users and TVL

Arbitrum is smol compared to Ethereum.

The chain’s TVL is $1 billion compared to Ethereum’s at $58 billion.

Source: DeFiLlama

Further, Arbitrum is a ghost town compared to the mother chain. Arbitrum has attracted just 1 million unique addresses compared to 200 million for Ethereum. Arbitrum averages around 100 thousand transactions per day compared to Ethereum at 1.2 million.

But the trend is clear. Both Ethereum Layer 2’s have seen a steady increase in activity throughout 2022 despite a brutal bear market, growing from 20-40k daily transactions to >100k in a span of seven months. It’s only a matter of time before the leading L2s surpass the daily transaction activity of the Ethereum L1.

Source: Etherscan, Arbiscan, and Optimistic Etherscan

But what is going to drive Arbitrum to surpass Ethereum in total users and daily transactions? In addition to marketing efforts such as Arbitrum Odyssey (#wen), the biggest driver for continued adoption of the chain may be its novel ecosystem.

(3) Novel Ecosystem

The amount of innovation on Arbitrum is difficult to keep up with.

According to DeFi Llama, Arbitrum is already home to 108 protocols, #6 overall despite only being a year old.

Remember, this is pre-token and pre-ecosystem fund.

More importantly, the projects native to Arbitrum stand out in a crowded field of crypto protocols. The chain is particularly strong in derivatives. No less than seven protocols native to Arbitrum are going after the derivatives market.

As a I wrote in my profile on GMX, Arbitrum’s #1 application, the derivatives market is a top market opportunity in crypto, by both revenue and users. Derivatives are far more “white space” compared to other parts of the crypto ecosystems, such as DEXes, lending platforms, and stablecoins.

The smart contract platform space is crowded. Being a leader in the nascent on-chain derivatives market and a top destination for Ethereum developers will enable Arbitrum to stand out from the dozens of low-value Ethereum copy cats.

Conclusion - It’s Arbitrum Season

The macro backdrop is challenging. Tightening liquidity conditions, inflationary pressures, and general “risk off” sentiment will make the next year far more challenging for the crypto space compared to the highly favorable backdrop of 2020 and 2021.

Fortunately, Arbitrum has plenty of momentum. The Ethereum Halo Effect, the Favorable Relative Users / TVL, and the Novel Ecosystem suggest that Ethereum’s #1 Layer 2 is likely to emerge as a relative winner over the coming months and years.

So don’t let the VCs or market backdrop fool you: It’s Arbitrum season.

If you want to try GMX, Arbitrum’s leading protocol, be sure to use my ref link for 10% off trades on GMX, Arbitrum's #1 DEX: http://gmx.io/?ref=808trades