As Satoshi Nakamoto once famously said, “Be the narrative you wish to see.”

The narrative I wish to see play out over the coming years:

GMX: The On-chain FTX.

This piece explores:

Crypto Exchanges: Crypto’s Largest Fee Pool.

GMX Today: Leading Decentralized Perps and Swaps Protocol.

GMX Tomorrow: The On-chain FTX.

Let’s get right into it.

Crypto Exchanges: Crypto’s Largest Fee Pool

Crypto exchanges make bank.

In 2021, crypto exchanges like Binance, Coinbase, and FTX facilitated $50 trillion in spot volume and $5-10 trillion1 in perpetual swaps open interest.

Assuming a 5bps average fee on swaps volume and a 0.1% borrow fee on aggregate open interest, that is a $25 billion and $10 billion total fee pool for a total revenue opportunity of at least $35 billion across crypto exchanges.

Given the enormous amount of fees generated by exchanges facilitating the trading of crypto assets, is it any wonder crypto exchanges are the most valuable crypto companies by a country mile?

At the peak of the 2020-2021 bull market, Binance, Coinbase, and FTX were valued at more than $100 billion, $86 billion, and $32 billion respectively.

But the rise of centralized exchanges (CEXes) is yesterday’s narrative.

Crypto trading volumes are increasingly moving on-chain, from centralized entities like Binance and FTX to decentralized protocols like Uniswap (spot swaps) and dYdX (perps). Uniswap has seen its share of spot volumes grow from <0.5% to 2.7% over the past year, outperforming the market by a wide margin.

Why is this migration happening? In a nutshell, on-chain trading is more degen.

On public blockchains like Ethereum, traders can:

Access far more tokens. Thousands available on-chain vs. hundreds on CEXes;

Access more leverage. Binance is eliminating leverage altogether for European customers soon; GMX users are able to trade up to 30x;

Trade for less. A swap on Uniswap will set you back 0.3% vs. a trade on Coinbase can cost >1%; and

Use the protocols permissionlessly. No KYC / AML.

The spot exchange opportunity and the blowout success of Uniswap has spawned hundreds of me-too decentralized exchanges (DEXes). There are 249 listed on Coingecko alone.

Perpetual swap protocols are more nascent. There are only six listed on Coingecko.

How many protocols are going after both spot swaps and perps AND are both highly utilized and highly profitable for token holders TODAY?

Only one: GMX.

GMX Today: Leading Decentralized Perps and Swaps Protocol

GMX is a decentralized perps and spot protocol.

The protocol offers perpetual swaps with up to 30x leverage and spot swaps on a basket of crypto assets, including crypto tokens ETH, BTC, AVAX, LINK, and UNI, and stablecoins USDC, USDT, FRAX, DAI, and MIM. GMX is available on Arbitrum and Avalanche.

GMX sets itself apart from the competition in several ways. As laid out in great detail by Riley:

For traders: The protocol’s innovative GLP liquidity pool enables traders to incur zero-slippage on trades as compared to the standard x*y=k automated market maker (AMM) model introduced by Uniswap. Further, the protocol’s Chainlink oracle feeds pull from both Binance and FTX, reducing the risk of traders experiencing “scam wicks.”

For liquidity providers: LPs to the GLP pool don’t incur impermanent loss. LPs also enjoy exposure to an attractive basket of majors, split roughly 50/50 across ETH + BTC (AVAX, LINK, and UNI are tiny portions of the GLP) and stablecoins while earning a real-yield of greater than 20% (the GLP earns 70% of the fees generated by the protocol plus cumulative net losses by traders).

No need for hopium: the protocol is already highly successful across both perps and swaps today.

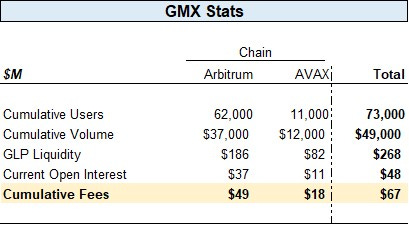

Since September 2021, GMX has attracted more than 70 thousand users and $268 million in liquidity, facilitated nearly $50 billion of exchange volume, and generated cumulative fees of $67 million.

Source: GMX Stats

The protocol is taking share of swap volumes from Uniswap and already has the deepest liquidity on Arbitrum.

Many are starting to take notice.

GMX has an impressive list of well-known CT supporters, including Arthur Hayes, The Crypto Dog, 0x_Messi, and AlgodTrading. Additionally, GMX has an unusually strong community. On Twitter you can easily find GMX supporters rocking a GMX Blueberry Club NFT PFP and a blueberry fruit in their Twitter handle.

86% of the protocol’s circulating token supply is staked, a reflection of the strength of the community. Including GMX liquidity on Uniswap and Trader Joe, the staking rate is comfortably above 90%.

However, stakers aren’t just enthusiastic community members. They are also shrewd capitalists. GMX stakers are earning a 23% APR, including ~8% real yield in straight ETH for an implied ~12x P/E multiple (GMX stakers earn 30% of the fees generated on the platform; remaining APR to stakers is GMX token incentives).

Despite GMX’s impressive success to date and the large market it’s going after, the protocol continues to be slept on.

GMX trades at a huge discount to protocol revenue -12x - compared to a basket of top DeFi protocols, which trade at high-double or even triple-digit multiples of protocol revenue.

The valuation discount is notable as decentralized perps are far less competitive than AMMs (recall 249 DEXes listed on Coingecko compared to just six derivatives players). Further, GMX is going after both perps AND swaps - its revenue opportunity is far greater than any other protocol listed above and should thus trade at a HIGHER multiple of earnings.

If the story stopped there, you would have makings of an interesting idea: a top protocol with great fundamentals pursuing a huge market opportunity trading at a deep discount.

But the story doesn’t stop there. Oh no anon. Some might say it’s just the beginning.

GMX Tomorrow: The On-chain FTX

GMX’s deepest flaw compared to competing perps protocols such as dYdX and Gains Network and AMMs such as Uniswap is its limited trading options.

While offering several benefits for traders, the GLP model is ultimately capital intensive, requiring significant collateral for leveraged trades. Critically, as a practical matter GMX effectively only offers ETH and BTC trading today as liquidity on the few alt coins in the GLP is thin.

GMX is working on two initiatives to address this issue: PvP AMM and X4.

PvP AMM: Synthetic Perps

Firstly, GMX plans to release an innovative synthetics product: the PvP AMM.

The PvP AMM is a self-contained, zero-sum synthetic asset pool that enables trading in any asset - crypto, stocks, bonds, FX - with significantly less capital required as compared to the GLP. The PvP AMM simulates the effect of leverage without leverage, thus the only capital required is the principal added by traders into the pool.

Introducing the PvP AMM enables GMX to compete on an equal footing with competing CEXes and on-chain perps protocols that offer far greater options for tradeable assets. GMX’s volume to date is essentially coming entirely from trading ETH + BTC. This compares to Coinbase which generates more than half of its volumes from non- BTC / ETH tokens.

At a minimum, opening up trading opportunities to more tokens should double the trading volumes on GMX. The actual impact is likely to be greater than 2x as the appeal of the platform is increased significantly with the inclusion of higher-beta small cap crypto coins.

You can find a detailed overview of the upcoming PvP AMM here. GMX is aiming to release the product over the coming weeks to months.

X4: GMX as Novel Uniswap Peer

Secondly, GMX is working on X4, a customizable AMM.

Standard AMM models have fixed parameters such as fixed fees or range of fees, limiting the control of how a liquidity pool is treated by pool participants. X4 allows full control of liquidity parameters, such as fees as a % of the trade, different fees based on actions (i.e. higher fee for sells vs. buys), and ability to pay LPs in a single token instead of a mix of tokens.

Enabling flexibility has several benefits, including attracting new projects and composability.

With a customizable pool, new protocols offering initial liquidity to the market can make initial buys very expensive. This would discourage large investors from buying all the tokens upon listing and enable smaller community members to participate in a promising new protocol’s public sale (ahem Alameda and Stargate ahem).

Further, with X4 it will be possible to mint yield-bearing tokens when entering a liquidity pool. These yield-bearing tokens can then be used elsewhere, such as Arbitrum-native collateralized-debt position (CDP) protocol Vesta Finance.

Flexible fees and composability are something that Uniswap can’t offer, creating an opening for GMX as an AMM innovation leader.

To address the issue of bootstrapping liquidity, X4 will function as an aggregator, with the ability to draw on liquidity from GMX’s GLP in addition to other AMMs such as Uniswap.

GMX speculates that X4 will transform AMM from a “place to trade into a platform for projects to build more of, or even their entire protocol on.” X4 has potential to make GMX not just a Uniswap competitor but also as fundamental infrastructure for the Arbitrum ecosystem, well beyond its already impressive list of 15 integrations.

GMX is scheduled to work on X4 after synthetics go live. You can read more about X4 here.

While the release of X4 is unlikely until later this year, you can already see GMX laying the foundation to become a formidable competitor in the AMM space.

GMX as Arbitrum Adoption Beneficiary

While the release of synthetics and X4 will surely help to attract users, the biggest tailwind for GMX may not have anything to do with the protocol.

GMX is the top protocol on the top Ethereum L2, Arbitrum, by both market cap ($200M) and TVL (~22% of total).

Arbitrum is in the very early innings of adoption, with ~1 million unique addresses compared to 200 million for Ethereum. As Arbitrum continues to attract users due to its low fees, slick UI, and strong BD (#wenNitro #wenOdyssey), GMX will certainly be a major beneficiary as the most prominent protocol on the chain.

With the release of PvP AMM and X4 later this year, GMX will offer traders deep liquidity across dozens of tokens for both perps AND swaps. With the increasing adoption of Arbitrum, 10’s to 100’s of thousands will inevitably find their way to GMX.

By then it will be obvious to all the narrative we’re seeding today:

GMX: The On-chain FTX.

Conclusion: GMX is the On-chain FTX

The fee opportunity for crypto spot swaps and perps is huge. The revenue opportunity is at least $35 billion.

Volumes are likely to increasingly move on-chain as on-chain trading is more degen: more tokens, more leverage, lower fees, and less friction.

GMX is a leading decentralized perps and swaps protocol. The protocol is already highly successful, facilitating roughly $50 billion of volume and generating $67 million of fees since launching in 2021.

Despite its success and despite only being ~0.2% penetrated, GMX continues to be slept on, trading at a significant discount to other top DeFi protocols.

The protocol is working on two major innovations to address its biggest weakness - limited tradeable assets. PvP AMMs and X4 are likely to attract significantly more activity to the platform. GMX also stands to benefit from further Arbitrum adoption, which is very early days.

GMX is on track to look like leading CEXes with deep liquidity across many tradeable pairs for both perps and swaps.

Be the narrative you wish to see.

The narrative I wish to see play out over the coming years:

GMX: The On-chain FTX.

If you want to try Ethereum’s most promising protocol yourself, be sure to use my ref link for 10% off trades on GMX, Arbitrum's #1 DEX: http://gmx.io/?ref=808trades

Spot per Coingecko APIs, perps OI my crude estimate vs. data from The Block.

superb read thank you!

https://app.gmx.io/earn?ref=moonisland