Ethereum is the Better Bet

The Winning Cryptocurrency is Likely to be the One That is Most Used; It’s Not Enough to be “The Hardest Money”

One of the most important questions new capital entering the crypto ecosystem must ask is where to place its bets. As the two largest cryptos worth more than 50% of total crypto market cap, the relative question of Bitcoin vs. Ethereum is likely the most important question to ask for institutions and high net worth individuals hoping to outperform the asset class.

Bitcoin is a formidable #1 crypto asset. 13 years since the creation of the first cryptocurrency, Bitcoin continues to dominate the asset class.

The OG crypto is currently worth $420 billion and commands ~38% of all cryptocurrency market cap. Bitcoin has the most brand recognition by a mile, with ~3x the Google search volumes of Ethereum, the #2 cryptocurrency. It also has the most institutional buy-in. Bitcoin is the only crypto that both a public company – MicroStrategy – and a country – El Salvador – have literally gone all-in on.

Bitcoin’s rise from nothing to a $1 trillion+ asset in a little more than a decade is perhaps most incredible technology story of all time.

However, despite Bitcoin’s preeminence today, it is highly likely that it will lose its dominance over time. Bitcoin even risks potentially becoming irrelevant in the not-too-distant future.

It’s not enough to be “The Hardest Money,” the most decentralized, or the most secure.

These are all desirable attributes of an internet-native currency. But they are unlikely to define the internet money that wins out.

The ultimate winning internet-native money will be the one that is the most used.

By this most important metric, Ethereum is the better bet as the future #1 largest and most durable cryptocurrency.

The Most Used Crypto Will Win

Fiat money, the status quo money instrument cryptocurrency seeks to disrupt, and specifically the king fiat currency – the US dollar (USD) – is the best example of how it is adoption and not other factors that are likely to define the winning cryptocurrency.

Based on properties alone, the USD is deeply flawed.

A core property of USD is it perpetually loses value. The dollar has lost more than 96% of its value over the past century. Economist Saifedean Ammous estimates annual debasement may be as high as 8% per year.

Further, the USD is used as an instrument of aggression by its creator – the US Government. The USD’s position as global reserve currency has enabled the USA to finance perpetual war, forcing other countries to bend to preferred US policy under threat of sanctions or even invasion and violence.

The USD’s defining properties of debasement and financing medium of a hostile hegemon are not ideal for its users – US citizens or the US’ trading partners.

But it hasn’t mattered.

Despite accumulating a more than $10 trillion trade deficit and more recently attempting to erase a country from the global financial system, 59% of global foreign exchange is conducted in US Dollars. The second and third most common currencies are the Euro at 21% and a basket “Other” currencies at 10%. The USD dominates.

Why? Because the US Dollar is the most ubiquitous currency.

The United States of America has the world’s largest economy and military. Over decades of growing trade and military might, the USD has become the world’s most used currency. As the largest consumer market and military power, the USA gets to dictate the terms of trade far beyond its 24% share of global GDP.

And this is despite the dollar falling in value every single year and the US’ history of foreign aggression.

In other words, it is not the properties of the dollar, but its adoption that has determined its success.

Bitcoin is Unlikely to Be the Most Used Crypto

Compared to Bitcoin, Ethereum has a dramatic advantage for potential widespread adoption.

The advantage crosses two general and interrelated areas – the tech and the culture. Ethereum’s tech and culture foster innovation and encourage adoption. Bitcoin’s does not.

Bitcoin’s key characteristic is its immutability. Of all the cryptocurrencies, it’s the most immune to change. 21 million coins. Always and forever. “Hardest money known to man.” Because of its resistance to change, Bitcoin is touted as the ultimate Store of Value (SoV).

To Bitcoin’s credit, the SoV meme has unlocked crypto’s first $1 trillion+ use case. However, Bitcoin’s core SoV use case opens up several underappreciated issues for the #1 crypto.

What exactly do you do with a store of value? Hold it, accumulate it, hoard it for consumption at some unspecified point in the future.

In other words, not much.

That value proposition sounds a lot like other existing stores of value, namely gold. While gold continues to be the world’s largest asset by market cap at roughly $11 trillion, the yellow metal is losing share of global assets.

Gold has no utility and pays no yield (i.e. cash flow). On the other hand, competing stores of value such as stocks, bonds, and real estate pay holders to own them via yield. Further, stocks and real estate often appreciate at a higher rate than gold and offer increasing yields on investors’ cost basis via growing cash flow streams.

More capital appreciation PLUS a growing cash flow stream? For savers, what’s even the point of holding gold? It’s a good question, and likely one that’s going to become more relevant for Bitcoin as Ethereum and other yield-generating crypto assets become better understood.

While Bitcoin improves upon some of the weaknesses of gold, such as transportability and divisibility, a static technology that’s biggest value proposition is to literally do nothing with it risks being outcompeted by superior alternatives, just as gold is losing out to yield-generating assets.

Similarly and a point not appreciated enough in the Bitcoin community, Bitcoin’s value proposition as a “sit it and forget it” asset will increasingly weigh on its future value proposition as a Store of Value.

Bitcoin’s long-term security model is dependent on a robust fee market. Mining rewards, which comprise ~98% of Bitcoin’s security budget today (~$18 million vs. <$0.3 million in daily fees), exponentially decline at a 50% rate every four years. Bitcoin halvings dictate that Bitcoin rewards are decaying fast and will need to be replaced by robust fee generation in the not-too-distant future:

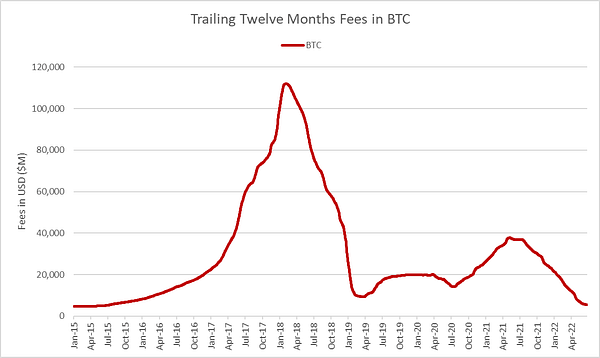

Store-of-Value use case is incongruent with lots of activity and thus fees. Cycle-to-cycle, the Bitcoin network’s fee generation in Bitcoin terms is down more than 60%:

The issue is likely to become worse over time. Uncertainty around whether Bitcoin will generate enough fees to support the network in the long-term raises doubt about the cryptocurrency’s attractiveness as a Store-of-Value asset.

In other words, can Bitcoin really be a Store of Value if users can’t say with 100% certainty whether the network will be around in 100, 50, or potentially even as little as 20 years?

Ethereum Encourages Adoption

In contrast, Ethereum encourages adoption in a way that is fundamentally not true of Bitcoin.

The most important feature of Ethereum is smart contract functionality. Smart contract functionality enables a virtuous cycle of development and user acquisition that Bitcoin doesn’t have.

The ability to develop applications on top of Ethereum and critically issue a token for developers and early users to benefit from their work is perhaps the most important difference between the two chains.

For much of its history and even to this day, the USA offers desirable resources such as cheap land, education, and strong property rights to encourage entrepreneurs to build companies that grow the US economy and continually raise its citizens’ standard of living.

Similarly, Ethereum offers developers the opportunity build innovative applications that unlock enormous amounts of value for users bold enough to explore the cryptocurrency and public blockchain frontier.

The first breakout application was initial coin offerings (ICOs) in 2017. The second was decentralized finance (DeFi) applications like Uniswap and Aave in 2020. The most recent breakout application was non-fungible tokens (NFTs) in 2021.

All of these applications attract new users to Ethereum and encourage usage of the blockchain. In fact, Ethereum has already attracted twice as many users as measured by addresses with >$0 balances (86 million vs. 43 million) and generated 47 times (!) more fees over the last-twelve months (~$9 billion vs. $0.2 billion) despite being six years younger than Bitcoin:

Source: Glassnode

Ethereum has made tens of thousands of individuals wealthy beyond simply HODL’ing ETH. The cumulative value of applications built on top of Ethereum is in the tens of billions.

As long as it’s possible to build new applications and reap the rewards of risk-taking, Ethereum will continue to attract talented developers and early adopters to create the next frontier of applications that attract the next billion users of Ethereum.

The technology is reflective of the culture of Ethereum. Whereas Bitcoin culture is extremely conservative and resistant to change, Ethereum culture is open-minded, self-aware, and risk-seeking.

The most prominent example of Ethereum’s innovative culture is the Ethereum Merge. The Merge and the move from Proof-of-Work (PoW) to Proof-of-Stake (PoS) consensus is a highly risky endeavor for a chain that is already wildly successful. However, the Merge undoubtedly makes Ethereum stronger, providing more security at far less cost and energy consumption.

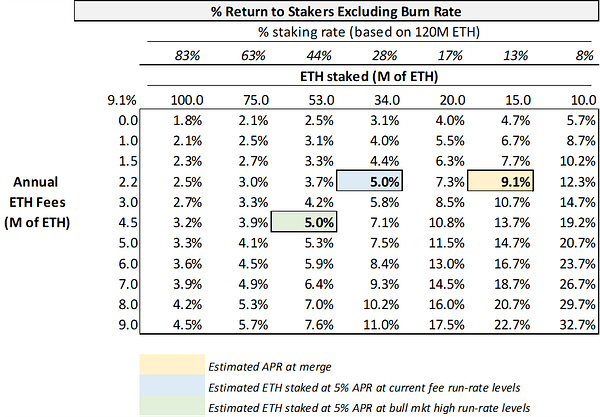

Perhaps most importantly, the Merge offers Ethereum token holders an opportunity to earn yield. Depending on the percent staking rate and activity on Ethereum, the yield to Ethereum stakers is likely to range from 5-10%:

As Bitcoin is unable to generate native yield, post-Merge Ethereum is likely to attract incrementally more capital just as gold continues to lose share of global assets to yield-generating alternatives such as stocks, bonds, and real estate.

But the Merge is just one piece of a longer development roadmap. Over the next decade the Ethereum Merge is followed by:

The Surge (introduction of sharding and massive scaling of the chain).

The Verge (introduction of Verkle Trees and further scaling).

The Purge (streamline storage and bad debt).

The Splurge (series of smaller upgrades to ensure Ethereum runs smoothly).

A robust fee market will be critical for any cryptocurrency that aspires to be #1 long-term. With Ethereum, you know a robust fee market exists today and that developers are likely to continue to be heavily incentivized to develop on the chain and attract more users to grow the fee market for decades to come.

Each new dollar of capital invested in the cryptocurrency asset class will increasingly ask themselves why risk betting on Bitcoin “figuring it out” when Ethereum is delivering today.

It’s All About Adoption; Ethereum Encourages Adoption

In summary:

Adoption and ubiquity has determined the success of existing currencies such as the US dollar, not the properties of the currency such as “soundness.”

Ethereum has built a superior system to encourage adoption relative to Bitcoin. A robust application ecosystem and yield-generating properties likely attract incrementally more users and capital compared to application-less and yield-less Bitcoin.

A cryptocurrency cannot thrive over the long-term without a vibrant fee market. The Ethereum model maximizes the likelihood of robust fee generation well into the future. The Bitcoin model does not.

Like how gold has been outflanked by fiat and yield-generating store of value assets, Bitcoin is likely to be overtaken by a technology with a stronger value proposition such as Ethereum.

The Ethereum community’s ability to foster innovation and layout a compelling path to building an increasingly stronger public blockchain over the coming decades suggests Ethereum is more likely to be the most adopted and largest cryptocurrency in the medium- to long-term. Further, Ethereum’s culture of risk-taking and innovation suggests Ethereum has a lower risk of being outflanked by an alternative technology in the future.

Thus, Ethereum is the better bet.

Writing takes an immense amount of time and effort. You can further support my work by:

(For traders) Using my ref link for 10% off trades on GMX, crypto’s #1 trading platform: http://app.gmx.io/?ref=808trades.

(For everyone else) Making a smol donation via my ETH wallet: 0x8Ab68C848749956e9F26d8a76C1FCB60817366c1.

really enjoyed the piece.

one issue I'm wrestling with is the BTC x gold relationship. Not sure that I agree with the premise "ppl now think gold is useless, so BTC will be useless."

First of all, gold is still around and still utilized as a store of value. Just because it hasn't grown substantially in the last 20 years doesn't mean it will not experience another period of growth going forward? Secondly, gold is becoming obsolete because of how difficult it is to actually utilize (storage, transferring, divisibility). BTC does solve these issues (mostly).

Anyways, this is a bit of a ramble, but, to me, arguing that Ethereum will win is a really short-term argument. Just like fiat currency domination comes and goes w/ debt cycles, you could make the case that ETH is just the first wave of crypto-fiat... and that BTC will win by survival -- just as Gold has outlasted other fiat currencies over the centuries?

Not sure if I agree with myself, but needed to type this out after reading lolz.

Again -- really loved the post.