Crypto’s original breakout use case was store-of-value and Bitcoin. Its second breakout use case was world supercomputer and Ethereum.

It’s third breakout use case? Digital dollars, aka stablecoins.

Stablecoins were the last crypto cycle’s biggest success story, growing from less than $1 billion in circulation at the peak of the 2017 cycle to $180 billion in circulation at the peak of the most recent cycle. Current stablecoins in circulation remain greater than $150 billion, or down ~20%, faring much better than cryptocurrencies’ total market cap drawdown of 70% from its $3.1 trillion high.

Clearly stablecoins are here to stay.

There was one stablecoin that rose above the rest this cycle. The coin is so popular it’s reaching new market cap all time highs when everything else is #DownBad. It even spawned a popular Twitter account despite having no way to profit from promoting the token.

The coin is USDC. The company that issues USDC is Circle.

Below is all you need to know about USDC, Circle, and the stablecoin market opportunity.

Circle / USDC Overview

Circle Internet Financial Limited (“Circle”) was founded in 2013 by serial entrepreneur Jeremy Allaire in Boston, MA. Circle is one of the oldest crypto companies and has undergone several pivots over its history. Circle was originally founded as a bitcoin company and acquired an exchange Poloniex in 2018 with a vision to become a “one-stop-shop” for crypto. Circle subsequently divested the exchange in 2019.

The company is a prolific fundraiser. Since founding Circle has raised $1.1 billion according to Crunchbase across at least six discrete funding rounds.

Circle’s breakout product has been its stablecoin - USDC.

USDC is a fiat-collateralized stablecoin. Stablecoins are a class of crpytocurrencies pegged to a fiat currency, almost exclusively the US dollar which makes up roughly 98% of stablecoin volume. Stablecoins have perhaps the strongest Product-Market Fit (PMF) in crypto and experienced explosive growth over the past few years, growing from less than $1 billion in circulation in 2017 to more than $180 billion earlier this year.

Stablecoins primary use cases today include:

Capital Markets: Trading pair for other cryptocurrencies on centralized exchanges. Tether’s USDT is dominates this arena as the preferred stablecoin across 100’s of crypto exchanges; and

Decentralized Finance (DeFi): A source of liquidity on public blockchains such as Ethereum. USDC is #1 in DeFi applications.

Due to their low-cost and instant settlement, stablecoins also have strong potential in other areas of traditional finance, including payments, remittance, and capital markets. These areas are nascent.

What Makes USDC Unique: TRUST

What makes USDC unique relative to the 101 stablecoins listed on Coingecko is its extreme approach to building trust.

Per Circle’s CFO Jeremy Fox-Geen in a July 5th blog post:

“We aspire for digital assets to be used by billions of people to exchange trillions of dollars of value every day. This can only happen if the underlying money is sound. So our economic incentive is to minimize risk with USDC. So that’s what we do. We minimize risk. So that USDC is always redeemable 1-1 for US dollars. Always.”

Below is a discussion of how Circle creates complete trust that USDC is “always redeemable 1-1 for US dollars.”

Someone deposits a dollar with Circle and in return receives USDC, a tokenized version of that dollar. Circle places 100% of the dollars it receives in reserves. Said another way every single USDC is backed 1-for-1 with a dollar sitting in its reserves.

Creating USDC by depositing dollars is referred to as “minting.” Burning USDC for dollars is referred to as “redeeming.” USDC can be redeemed at any time, 24/7. Hundreds of millions of USDC are minted and redeemed every day.

The reserves are held in the most liquid and conservative assets possible: cash and 3-month Treasury Bills. The 20% of reserves held in cash are kept with leading crypto banks Signature Bank, Silvergate Bank, and New York Community Bank. The 80% held in 3-month Treasury Bills are bought by asset manager BlackRock and held in custody by The Bank of New York Mellon, two of the largest and most trusted financial institutions in the world. Customers who have accounts with Circle’s banking customers are able to near-instantly mint or redeem USDC 1-for-1 with USD.

Circle is regulated under US state money transmission laws like major payments companies. By law, unlike a bank, exchange, or unregulated institution, Circle can’t lend reserves out, can’t borrow against its reserves, or use its reserves for operational reasons. Even in event of bankruptcy, creditors can’t come after Circle’s reserves.

You can see how USDC is truly “always redeemable 1-1 for US dollars. Always.”

USDC vs. Other Stablecoins

Compared to other stablecoins, USDC is in its own league when it comes to conservatism.

Relatively conservative collateralized debt position- (CDP) backed stablecoins such as MakerDAO or FEI are mostly backed by crypto assets. Algorithmically-backed stablecoins such as Luna and Frax are backed by their own stablecoins. Not exactly “risk free” if you simply want exposure to the dollar.

Relative to other stablecoins USDC is in a league of its own when it comes to conservatism

USDC’s backing is even more conservative than the Federal Reserve or highly-regulated banks such as J.P. Morgan, whose asset columns include higher-risk debt securities such as MBS and equity.

USDC is more conservative than the Federal Reserve

It is the most conservative arrangement of any stablecoin and any crypto institution. It’s even more conservative than highly-regulated banks. By design.

This is a key point about USDC and part of its competitive advantage that I believe is lost on many smart people in crypto.

Why does anyone buy a stablecoin? Because you want to hold dollars (or at least a digital representation of the dollar). The stablecoin that is most likely to win is the one that is the most trusted.

What is the most bulletproof way to make a stablecoin trusted? Make it easily redeemable 1-for-1 for a dollar with 100% assurance. Anything with less than 100% assurance is unlikely to win in the long run.

This is the primary reason why CDP or algorithmic stablecoins are likely to remain niche. This is also where the #1 stablecoin, Tether / USDT, made a grave error.

Tether is the OG backed stablecoin, first appearing in 2015, well before USDC’s emergence in 2018. The company gained broad adoption of its fiat-collateralized stablecoin USDT by focusing on the 100’s of offshore crypto exchanges. The effort has been extremely successful with USDT reaching more than $80 billion of adoption during its peak earlier this year.

However, the forward outlook for Tether is more challenged due to Tether’s sketchy business practices which have impaired trust in the stablecoin.

Tether is offshore and until recently mostly opaque. To make matters worse, in an effort to juice profits Tether goes far out on the risk curve seeking yield. According to Tether’s disclosures, at least 6% of USDT’s backing is in the form of digital tokens.

Tether is mostly - but not totally - backed by conservative assets

The murky nature of Tether’s operations and willingness to hold highly risky reserve assets has led to extreme levels of fear, uncertainty, and doubt (FUD) about whether USDT is actually fully-backed. These short-sighted business decisions have materially impaired trust in Tether and make it appear inevitable that USDC will surpass USDT as the #1 stablecoin.

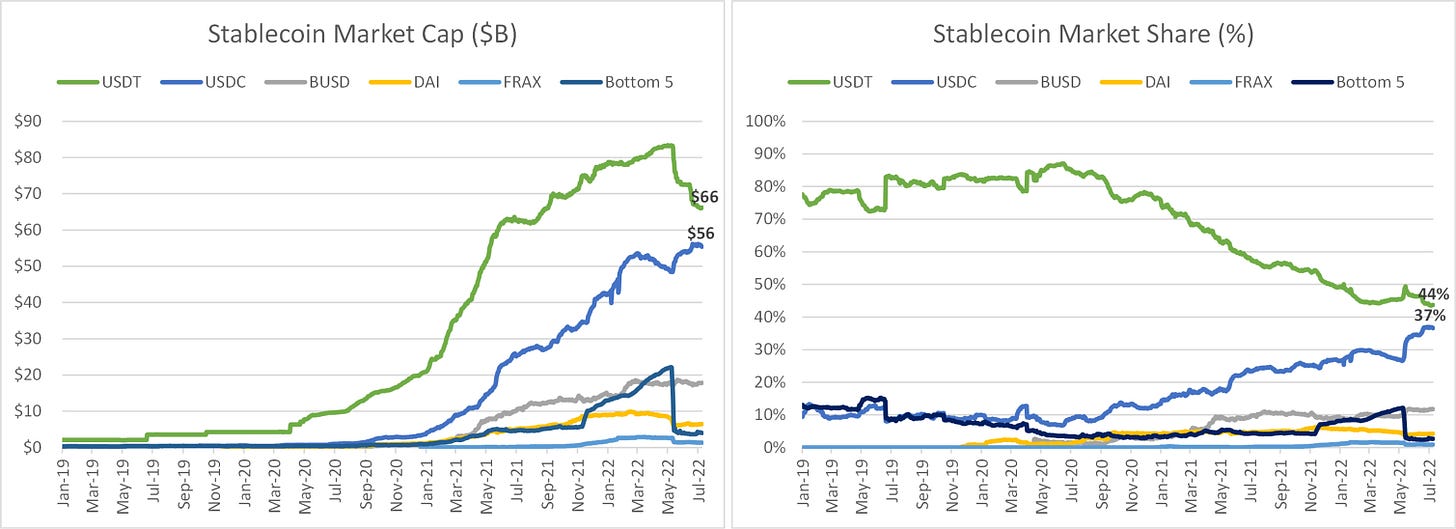

What is trust worth? A lot. USDC has been the clear winning stablecoin this cycle, gaining >$50 billion of market cap and nearly 20 points of market share since the beginning of the bull run.

Source: Coingecko

Now that we understand it’s all about trust with stablecoins and that USDC has the most trust in the game, let’s explore USDC’s longer-term opportunity.

The Market Opportunity

Circle’s IR deck quantifies USDC’s opportunity as Global money supply at $133 trillion and Global Payments at $35 trillion. If we more narrowly focus on US money supply, there’s currently $22 trillion US dollars in circulation. Assuming that grows inline with its 30-year compounded annual growth rate (CAGR) of 6%, USDC’s TAM will be nearly $40 trillion by 2030.

How much M2 will exist as US dollar stablecoins? Given that $150 billion currently exists relative to total crypto market cap of $1 trillion, or roughly 15% of the total, it’s easy to imagine US dollar stablecoins growing to to $1-2 trillion in the event that total crypto market cap reaches $10-20 trillion and bitcoin reaches gold’s market cap of $10 trillion.

If we wanted to break that $1-2 trillion forecast down further, $150 billion in stablecoins already exists today. These are driven by capital markets and DeFi demand. Assuming crypto market cap grows it seems like a safe assumption that demand to trade and speculate onchain will grow with it.

But what about other markets outside of crypto? Is the market opportunity really so narrow as to only facilitate crypto speculation?

Payments presents an interesting opportunity for stablecoins.

Most likely don’t appreciate especially if you’re lucky enough to live in the developed world but the current payments system is abysmal. For the consumer, there’s no standard for acceptance (Visa, Mastercard, AmEx? Debit? Cash? PayPal?). For the merchant, they either have to accept cash, which is difficult to account for, or take debit and / or credit, which costs 2-3% or more of the payment value to pay the banks for privilege of processing the transaction. Even worse it can takes days or even weeks for the merchant to receive their cash. Sending money international? That’ll be 5-6% to remittance provider Western Union.

With stablecoins, you can enable instant settlement for less than a penny by simply scanning a QR code. Circle’s demonstrating this functionality with Solana Pay. As public blockchains like Solana or Ethereum attract more capital, there will be increasing ability to use USDC in the real world with USDC and payments applications like Solana Pay.

More generically, USDC is already compatible with payments powerhouses like Visa, Stripe, Worldpay, and Checkout.com, among others. You can see the building blocks being put in place to support the increasing use of USDC in the real world.

The remittance industry is toast if USDC adoption becomes ubiquitous. You can send USDC anywhere in the world for pennies with public blockchains. Say “Aloha!” to the 5-6% pound-of-flesh Western Union takes on every international money transfer.

Capital markets are another huge opportunity for stablecoins and USDC.

Asset managers like BlackRock and investment banks like Goldman Sachs settle trillions dollars worth of asset transactions every day on decades-old technology. For the same reason crypto promises to improve upon the existing payments paradigm, traditional capital markets stand to benefit from blockchain technology. In fact, in Circle’s recent fundraising announcement, there was this notable quote: “BlackRock has entered into a broader strategic partnership with Circle, which includes exploring capital market applications for USDC.”

Payments and capital markets opportunities are unlikely to move the needle near-term but are exciting opportunities longer-term.

Circle as the Stablecoin Juggernaut

One peculiarity of the stablecoin opportunity worth reflecting on is how weak the competition is.

The #1 stablecoin player - Tether - is offshore with sketchy business practices. The #3 stablecoin - BUSD - is likely limited to Binance’s trading operations as Binance’s stablecoin and reliant on a third-party tech provider - Paxos. The long tail of onchain stablecoins like MakerDAO or Frax are destined to be niche. They won’t be able to compete with USDC’s trust, deep liquidity, and utility.

As you likely picked up on from the quality of Circle’s partnerships mentioned earlier, the company is unmatched in business development. Further, according to LinkedIn employee data, Circle appears to be the only project going aggressively after the stablecoin opportunity. Circle has multiples the employees of comparable stablecoin projects and is hiring far more aggressively:

As of 7/9/22; Note based on LinkedIn data - stats may undercount Tether and Maker; Paxos data not apples-to-apples as they are pursuing several business opportunities other than their stablecoin.

Compared to other massive crypto use cases like bitcoin’s store-of-value or Ethereum’s layer one smart contract platforms, which have attracted billions in capital and intense investor interest, stablecoins have received relatively little focus from venture capitalists. Why?

There are many reasons, such as competition, risk of CBDCs, and perception of commodity service with no path to value capture.

But how realistic are each of these risks? Let’s think this through.

Competition: As mentioned earlier, Circle’s competition is weak. There is risk that once there is regulatory clarity, traditional firms such as banks may enter the fray. Whenever they do they will be miles behind. Not only will they be fighting against USDC’s well-established trust, they’ll be fighting against Circle’s dozens of integrations and deep liquidity. This thread walks through all the ways that Circle is working to become the stablecoin standard:

Per the thread, USDC is compatible with dozens of L1s, more than 200 digital wallets, adopted by name-brand traditional finance companies like BlackRock and Visa, and has robust APIs that enable developers to easily integrate USDC. Every day that passes and every incremental USDC that is minted there is less reason for each new market participant to choose any other stablecoin. Stablecoin initiatives from banks such as Silvergate and the USDF Consortium which have yet to hit the market are likely to struggle to gain adoption.

CBDCs: Central Bank Digital Currencies are a moral quandary. In the United States, the creation of money is handled by banks via lending. CBDCs would create a direct money relationship between the government and its citizens, a relationship currently being exploited by the Chinese Communist Party that makes many in the West uneasy. A US CBDC risks serious invasions of privacy and potential for the US government to censor citizens.

Circle represents an elegant solution to this moral hazard. The role of managing the administration of digital currencies would be arms-length through private sector entities like Circle while also being easy to closely regulate as a centralized entity.

Circle’s CEO is keenly aware of the risks (and opportunities) of regulation. He can be regularly spotted at high-profile political events, such as a recent retreat with senior House Democrats:

No path to value capture: Stablecoins promise to be far cheaper than existing solutions. Anyone can spin up a stablecoin (there are over 100). How would anyone make any money?

Simple: With scale.

Circle primarily makes money on the interest it accrues from the 80% of reserves it holds in 3-month Treasury Bills. Circles’ interest income opportunity by 2030 assuming $200 to $500 billion USDC in circulation, vs. $56 billion today, and 3% yield on t-bills could range from $5-12 billion. $500 billion would only represent 1-2% of forecasted US M2. If USDC becomes as ubiquitous as email in our day-to-day lives, the upside is obviously far higher.

This just represents the USD opportunity. Circle is rolling out other fiat currencies, including the Euro. EUROC was introduced in June:

Many have speculated that Circle will eventually have to pay out the interest on reserves the company earns on the USDC it issues. That seems unlikely.

Like holding cash, USDC holders are holding the token for its utility (i.e. ability to participate on public crypto blockchains with a fully-backed US dollar equivalent). Further, individuals seeking yield on their USDC have many options (e.g. here’s single-sided 5% APY on your USDC with no risk of impermanent loss).

Assuming USDC remains the most liquid stablecoin with the most utility, it is unlikely that USDC will have to pay out its income on reserves to drive demand for the token.

CND Thoughts

Circle announced in July 2021 it intends to go public via a $4.5 billion SPAC with Concord Acquisition Group (ticker: CND). In February 2022, Circle announced its SPAC valuation was increased to $9 billion as a result of USDC in circulation exceeding expectations since the original deal was announced.

The SPAC remains under review by the SEC. Since the SPAC bubble in 2021, the SEC has put the brakes on crypto-related SPACs. Companies seeking to go public via SPAC like Circle and internet brokerage firm eToro remain in limbo. It is unclear if Circle will be able to go public before its agreement with CND expires by January 2023.

Assuming Circle succeeds in going public, caution is warranted in the near-term.

As previously noted, Circle has raised more than $1 billion since its founding in 2013. Many early investors in Circle are likely eager to exit their positions. Recent fintech IPOs like Remitly (ticker: RELY) or SPACs like Skillz (ticker: SKLZ) have been #DownOnly as early investor selling overwhelms new capital inflows from public market participants. There is a risk similar dynamics play out whenever Circle lists.

Further, Circle shared updated financials as part of its updated SPAC valuation in February 2022. That forecast, which called for an average of $165 billion of USDC in circulation and $820 million of Adjusted EBITDA by 2023 is looking optimistic.

While USDC is faring far better than other stablecoins, it also has lost momentum due to the crypto crash. Assuming a more “realistic” forecast for USDC in circulation for 2023 of $80 billion, still up nearly 2x by EoY 2023 vs. today’s levels, Circle’s adjusted EBITDA would be ~$235 million.

Source for February 2022 Outlook here.

$235 million 2023 Adjusted EBITDA is nearly 40x Circle’s latest SPAC valuation of $9 billion, a level that is unlikely to hold in the public markets. If $235 million is closer to the correct number, Circle’s valuation could easily fall to $2-3 billion, or down 70-80% from its SPAC listing valuation of $9 billion.

Conclusion

Stablecoins are crypto’s third trillion dollar opportunity after bitcoin’s store-of-value and Ethereum’s world supercomputer.

Trust that a stablecoin will maintain a 1-to-1 peg with the US dollar is a stablecoin’s most important feature. Circle is gaining significant share of the stablecoin market due to its relentless focus on trust.

Tether, the #1 stablecoin, is likely to continue losing share as a result of optimizing for yield and sketchy business practices. Alternative stablecoin technologies such as algorithmically-backed or CDP are likely to remain niche as they can’t offer the trust of a fully-backed, legally-protected stablecoin.

Circle is the only project aggressively going after the multi-trillion stablecoin opportunity. The company’s business development is light years ahead of others. The company’s hiring is multiples of competing stablecoin projects.

DeFi and Capital Markets are stablecoins breakout use-cases today. Payments and traditional capital markets are breakout use cases of the future. Circle is working hard to crack new TAMs for stablecoins, partnering with traditional finance players such as Visa, Stripe, and BlackRock.

Just subscribed, keep it up

Perhaps Defi write a short article on how one can "invest" (so to speak) in stablecoins such as USDC. It would seem a coin pegged to the USD would only be priced within a narrow range, and in fact might depreciate (along with the USD) as the USD loses its petrodollar status. Is there some staking or other mechanism?