INTRODUCTION

Crypto VCs and journalists often opine on how Coinbase is “misunderstood” and “deeply undervalued.”

Study Coinbase for a few hours and it quickly becomes clear the company faces a highly uncertain and clearly unfavorable fundamental path over the next three to five years. People calling Coinbase “misunderstood” and “deeply undervalued” are naïve.

What this article IS NOT: A call on the company’s stock over the next 12-18 months. COIN’s stock is completely bombed out, down 84% from its direct listing price. If crypto “animal spirits” were to return the stock could do well over the near term.

What this article IS: A review of the obvious strategic and fundamental issues Coinbase faces over the medium- to long-term. Nobody knows whether Coinbase will be able to repeat the extraordinary fundamental success of the 2021 cycle, when it generated $8 billion of revenue, $3.6 billion of net income, and $14 of earnings per share. In fact, a sober analysis of Coinbase’s prospects suggests the company is unlikely to achieve this level of success again anytime soon, potentially never.

I also hope I am wrong. Brian Armstrong is a visionary, responsible for helping to greatly advance the crypto industry. Even more importantly, Brian is a believer in crypto’s higher-purpose of creating an alternative to the corrupt and byzantine fiat-based system. This is in stark contrast to profiteers like SBF who use crypto simply as a vehicle to become as rich as possible and endlessly virtue signal about “effective altruism” (🤮).

We should be rooting for people like Brian to succeed. But at the same time, we should not be blind to the issues facing his company.

With that, let’s dig in.

COINBASE AS EXTREMELY PROFITABLE CRYPTO RETAIL BROKERAGE

Understanding Coinbase’s long-term prospects first requires understanding what Coinbase is.

Coinbase frames itself as a Web 3 platform focused on “enabling economic freedom.” Here’s a slide from Coinbase’s investor presentations prior to its direct listing in April 2021:

A look at Coinbase’s financials reveals what Coinbase actually is: an extremely profitable crypto retail brokerage.

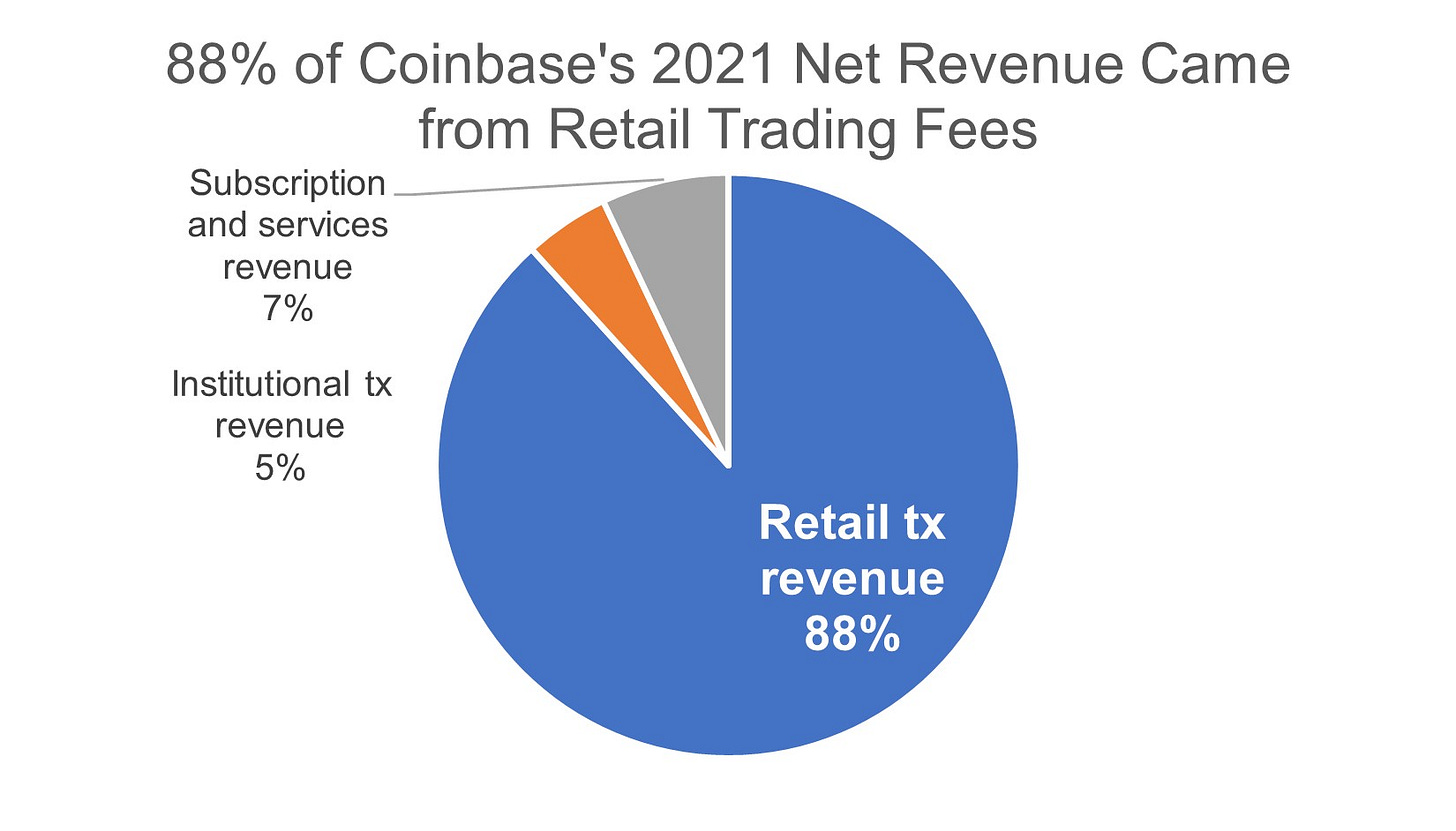

88% of the company’s 2021 net revenue came from retail trading fees, with 5% coming from institutional transaction revenue and the remaining 7% coming from dubiously named “Subscription and services revenue” (more on this later).

Breaking down 2021 results further, Coinbase facilitated $1.7 trillion of trading volume in 2021, with 68% coming from institutions and 32% coming from retail. While institutional volumes were more than twice as much as retail, Coinbase generated 18x more revenue from retail. Why?

Simple: Retail trades are far more profitable than institutional trades. Coinbase’s 2021 blended take-rate on retail trades was 1.21% compared to 0.03% for institutional, a difference of ~4000%.

Source: Company shareholder letters

When thinking about Coinbase’s medium- to long-term prospects, we must ask ourselves two questions:

Is this critically important retail trading revenue stream sustainable? and

Can other revenue steams grow to comparable or greater size?

In the medium-term to long-term, the evidence suggests the answer to both questions is likely “No.”

RETAIL TRADING REVENUE IS UNSUSTAINABLE

The primary issue Coinbase faces over the next three to five years is it is banking on the ignorance of its retail customer base to carry the company’s fundamentals until some other revenue stream breaks out.

There are many options to buy crypto for less than Coinbase’s 1.21% blended take-rate for retail trades, including on Coinbase’s own website.

As detailed in this article, Coinbase’s crypto brokerage, which Coinbase’s unsophisticated retail users use to buy crypto, charges a minimum 1.49% take-rate. For small dollar transactions the effective take-rate can go higher than 10%. Some would argue Coinbase’s pricing practices on its small unsophisticated retail customers are borderline predatory.

On the other hand, Coinbase’s trading-oriented app - Coinbase Pro - charges a max take-rate of 0.60%, 50% less than Coinbase’s overall take-rate, even for small dollar trades. Assuming Coinbase treated all its retail customers equally, a 0.6% fee rate would result in at least a 50% hit to Coinbase’s retail trading revenue. At least.

Why do Coinbase customers buy crypto through the brokerage application when there is a cheaper option through the same company? Because they don’t know any better. “Durable customer ignorance” is hardly a compelling long-term thesis for the company’s largest revenue stream.

But the problem goes farther than Coinbase gouging its existing retail customers. The current competitive environment is just about as favorable for Coinbase as it’s ever going to be. Competition will increase for Coinbase across three distinct vectors over the coming years: Crypto Exchanges, TradFi, and Onchain.

Crypto Exchanges: Due to regulation, Coinbase’s two strongest competitors - Binance and FTX - offer watered-down versions of their overseas offerings. For example, Binance US offers “over 100” cryptocurrencies vs. its parent which offers more than 600. Similarly, FTX US offers “upwards of 20 cryptocurrencies” while FTX offers more than 300 according to Coingecko. Coinbase supports 212 assets for custody and 166 for trading per its Q1 2022 shareholder letter. For now, the company has a distinct advantage in the US. But it won’t always have this advantage.

TradFi: Traditional finance powerhouses such as Goldman Sachs and J.P. Morgan are severely restricted from competing against Coinbase due to crypto’s unclear regulatory status - is it a security or a commodity? Once crypto’s regulatory status is clarified over the coming years, TradFi presence in the space will increase dramatically to the detriment of Coinbase.

Onchain: As cryponatives are already well aware, onchain is where the real action is. Investors have access to thousands of coins at a fraction of the cost of trading on Coinbase. For example, powerhouse decentralized exchange (DEX) Uniswap has over one thousand coins available on its platform for a flat 0.3% trading fee. DEXes like Uniswap have been taking share and that trend is likely to continue.

The data of crypto spot exchange volumes suggests Coinbase may already be seeing the effect of increased competition. It’s share of crypto volumes has been heading in the wrong direction for all of 2022:

If we agree that competition for crypto trading will likely continue increasing, where is this all going? Crypto trading fees likely go the way of stocks: to zero.

Internet stock brokerages reduced trading fees to $0 in 2019. This process is already beginning in earnest for crypto. Binance US announced free trades on bitcoin in June of this year. Expect more announcements like this in the future as crypto exchanges seek to grab a piece of Coinbase’s lucrative retail trading business.

At this point a Coinbase bull would likely counter “Coinbase is more than its retail trading business. The company has 89 million retail users, 11,000 institutions, and 210,000 ecosystem partners per its 2021 10k. Coinbase also custodies more than 10% of all crypto assets. The company will be able to create value far beyond whatever value is lost in the retail trading business.”

Coinbase is a powerhouse in the crypto space let there be no doubt. But it appears unlikely the company will be able to recreate a revenue stream equivalent to the company’s $6.5 billion retail trading franchise.

OTHER REVENUE STREAMS UNLIKELY TO MATCH RETAIL TRADING

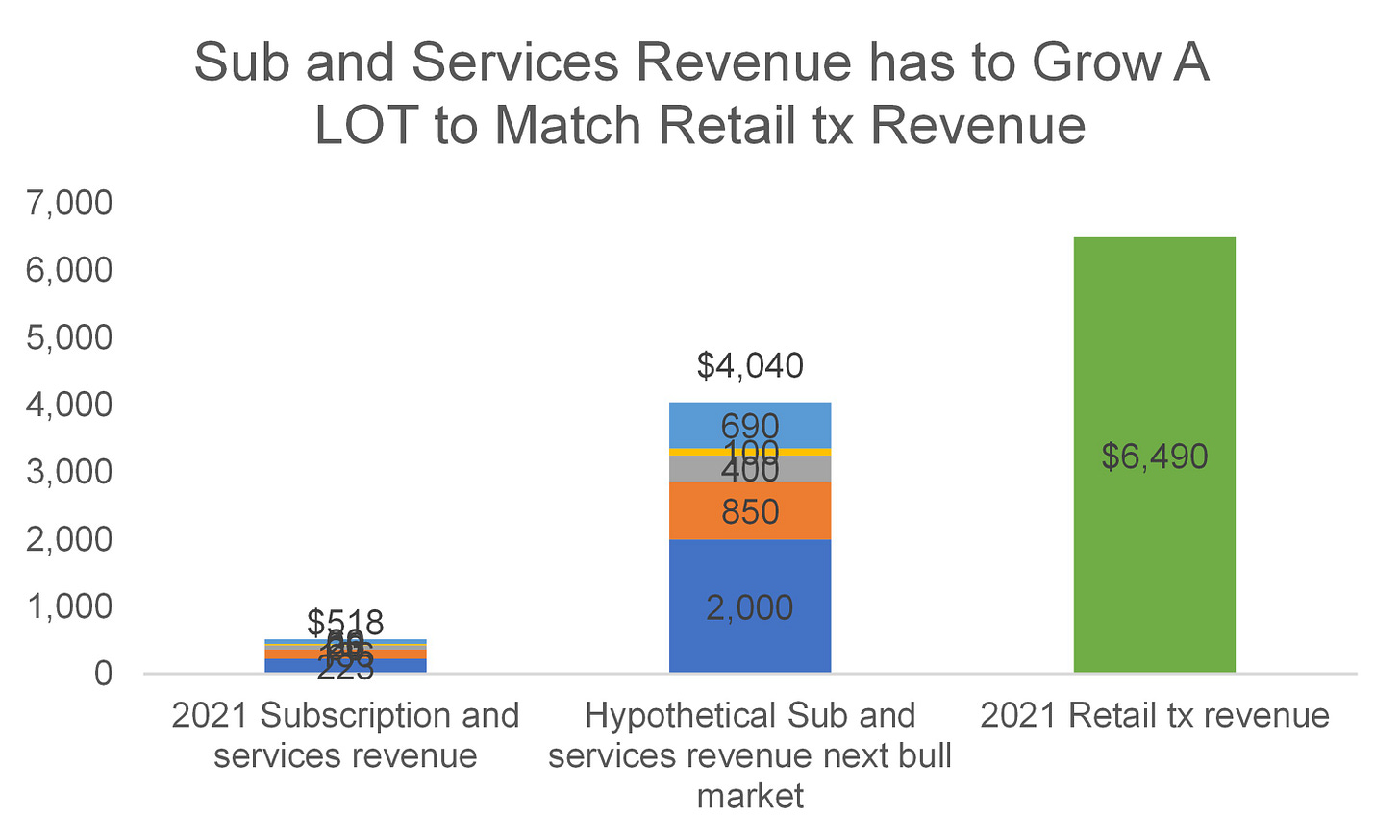

The 7% of Coinbase’s 2021 revenue dubbed “Subscription and services revenue” comes in five discrete buckets: Blockchain rewards, Custodial fees, Interest income, Earn campaign, and Other. Let’s break them down and make some optimistic forecasts around what kind of revenue these business could drive.

Blockchain rewards: This revenue line is the staking rewards earned by Coinbase from running validators, predominantly Ethereum. Let’s say by the next cycle Ethereum reaches $1 trillion cap and generates a 5% staking yield at a 30% staking rate, equating to a staking annual TAM of $15 billion. Further, assuming Coinbase maintains its current network market share of 14%, that equates to ~$2 billion of Blockchain reward revenue to Coinbase.

Custodial fee revenue: Coinbase earns a fee to custody crypto assets on behalf of its customers. For 2021, Coinbase custodied on average $234 billion of crypto assets and earned $136 million, implying a roughly 0.06% annual fee on assets. Total crypto market cap averaged around $1.6 trillion for 2021. Let’s say total crypto market cap reaches $10 trillion next cycle and Coinbase maintains share of custodied assets. That implies custody revenue would 6.25x to $850 million.

Interest income: Coinbase earns a revenue share on interest income earned by customer fiat funds custodied via the Coinbase platform. Let’s assume this revenue line item grows inline with custody fee revenue. 6.25x $63 million = $400 million.

Earn campaign: Coinbase earns a commission on cryptos distributed to its customers who engage with educational content regarding specific blockchain protocols. Let’s say next cycle that revenue stream jumps to $100 million just because.

Other subscription and services revenue: Primarily relates to Coinbase Cloud, the company’s crypto infrastructure platform. Let’s assume this 10x’s next cycle to $690M.

Assuming this super optimistic case plays out, Coinbase’s Sub and services revenue would equate to roughly $4 billion, much smaller than the $6.5 billion of retail trading revenue the business earned in 2021.

Critically, even if we assume that Coinbase delivers on this very optimistic case AND the Retail revenue is sustained next cycle, one would likely be better off buying crypto directly as opposed to a crypto proxy like Coinbase.

For example, in the above hypothetical we assumed that crypto market cap 10x’d vs. the $1 trillion level it’s at today. On the other hand, Coinbase’s revenue next cycle would equate to roughly $11 billion ($7 billion of tx revenue + $4 billion of Sub and services revenue). At the company’s current 3x enterprise value to sales multiple of 3x, that’d equate to a $33 billion company, or a bit more than a 3x from current levels.

It’s worth emphasizing this hypothetical outcome is optimistic. It appears likely that Coinbase’s retail transaction revenue will be competed away over time.

An ardent Coinbase bull may double down and say “Coinbase will figure out another revenue stream you’re not accounting for!”

Maybe, but the early indications here aren’t encouraging.

Coinbase has among the largest employee bases in crypto with more than 6,000 FTEs according to LinkedIn data. It appears it may be only second to Binance, which has more than 8,000. Insurgent exchange FTX runs relatively lean with around 600 employees.

According to Coingecko, Coinbase spot volumes are roughly 10% of Binance’s and roughly equal to FTX’s. Coinbase does not have a derivatives business but is likely to enter the space whenever the CFTC provides regulatory clarity on derivatives, which FTX is pushing hard for. Assuming crypto derivatives come to the US, Coinbase would be woefully behind Binance and FTX which dominate the current market.

Coinbase’s NFT foray, which the company spent extravagantly for, has been a total flop.

Banking on Coinbase to replace its lucrative retail trading revenue is a long putt, to say the least. Even in the unlikely even that Coinbase succeeds in building a large Subscription and services business, one is likely better off buying a basket of top cryptos.

CONCLUSION

Coinbase is almost certainly overearning in its core retail trading business. Retail trading services are highly commoditized; this revenue stream likely trends to $0 in the long-term. To compound the issue, Coinbase’s Subscription and services business is unlikely to replace the $6.5 billion in retail trading revenue the company earned in 2021. Coinbase’s attempts to build other marquee franchises outside of trading have underwhelmed, most obviously in its NFT efforts.

A sober analysis of Coinbase’s business reveals the company faces a highly uncertain and unfavorable fundamental path over the next three to five years. Think hard before following the advice of prominent crypto VCs and journalists. Many of these folks are NGMI.