Binance Smart Chain: Sleeping Giant

Is it Just a Matter of Time Before Major BSC DeFi Applications Emerge from this Bustling Ecosystem?

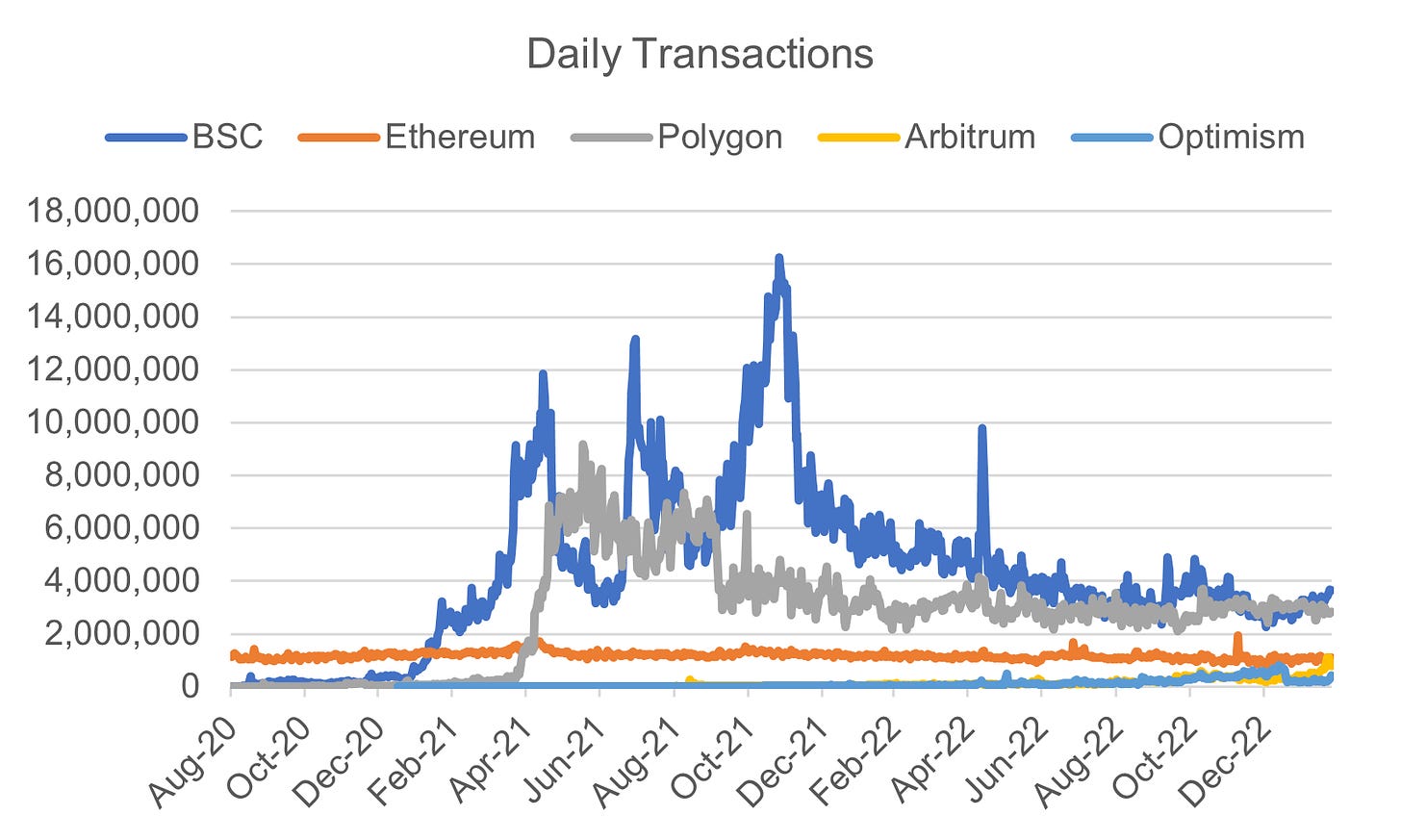

Did you know, amongst smart contract platforms Binance Smart Chain has the most:

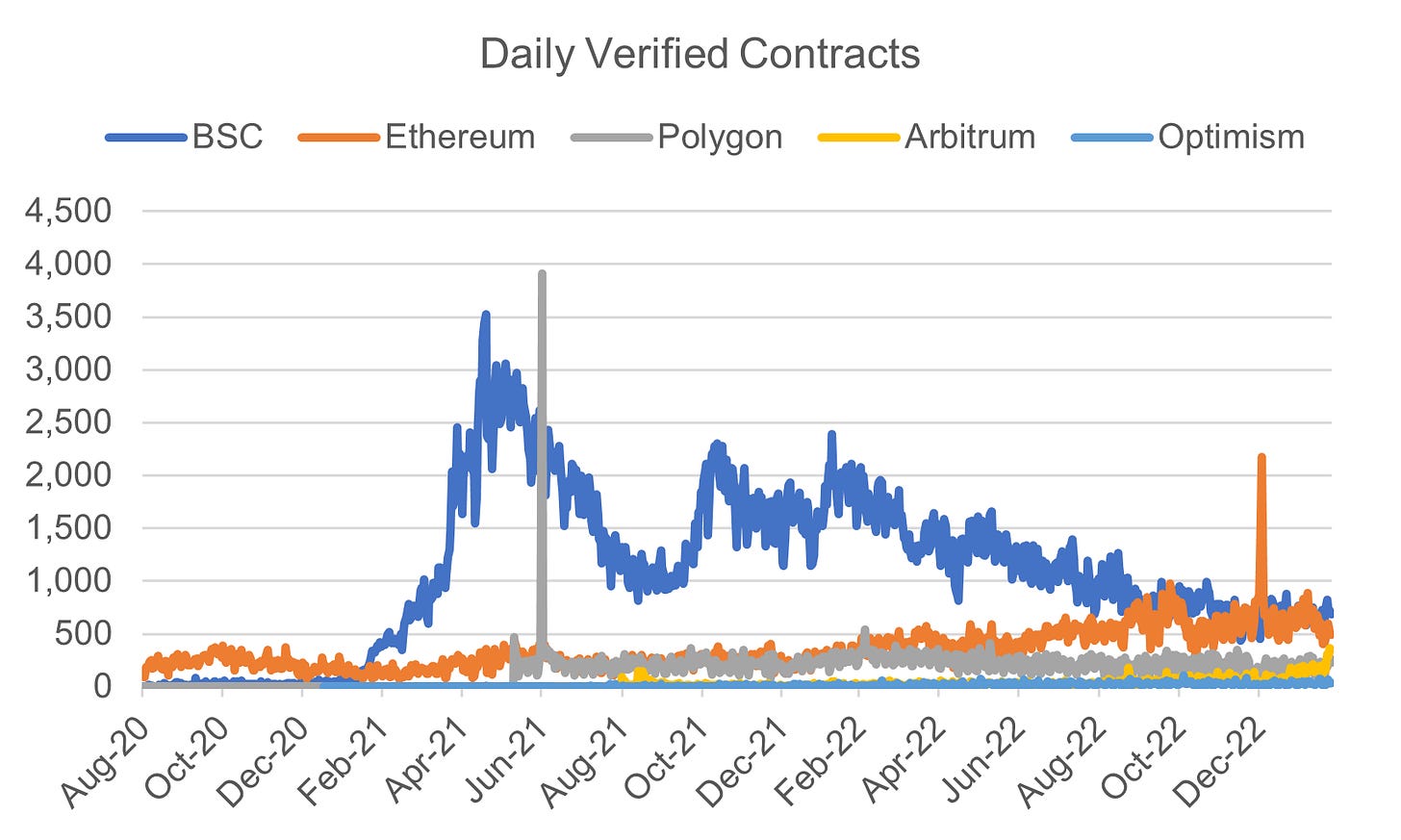

Daily transactions (3-4 million);

Unique addresses (260 million); and

Daily verified contracts (~700-800).

Binance Smart Chain is the most active chain, with the most users, and the most active builders. It’s pretty crazy especially considering how little mindshare the chain receives in the Crypto Twitterverse.

Binance Smart Chain is a Juggernaut Amongst Smart Contract Platforms

Source: Etherscan, BSCScan, Polyscan, Arbiscan, Optiscan as of 2/25/23

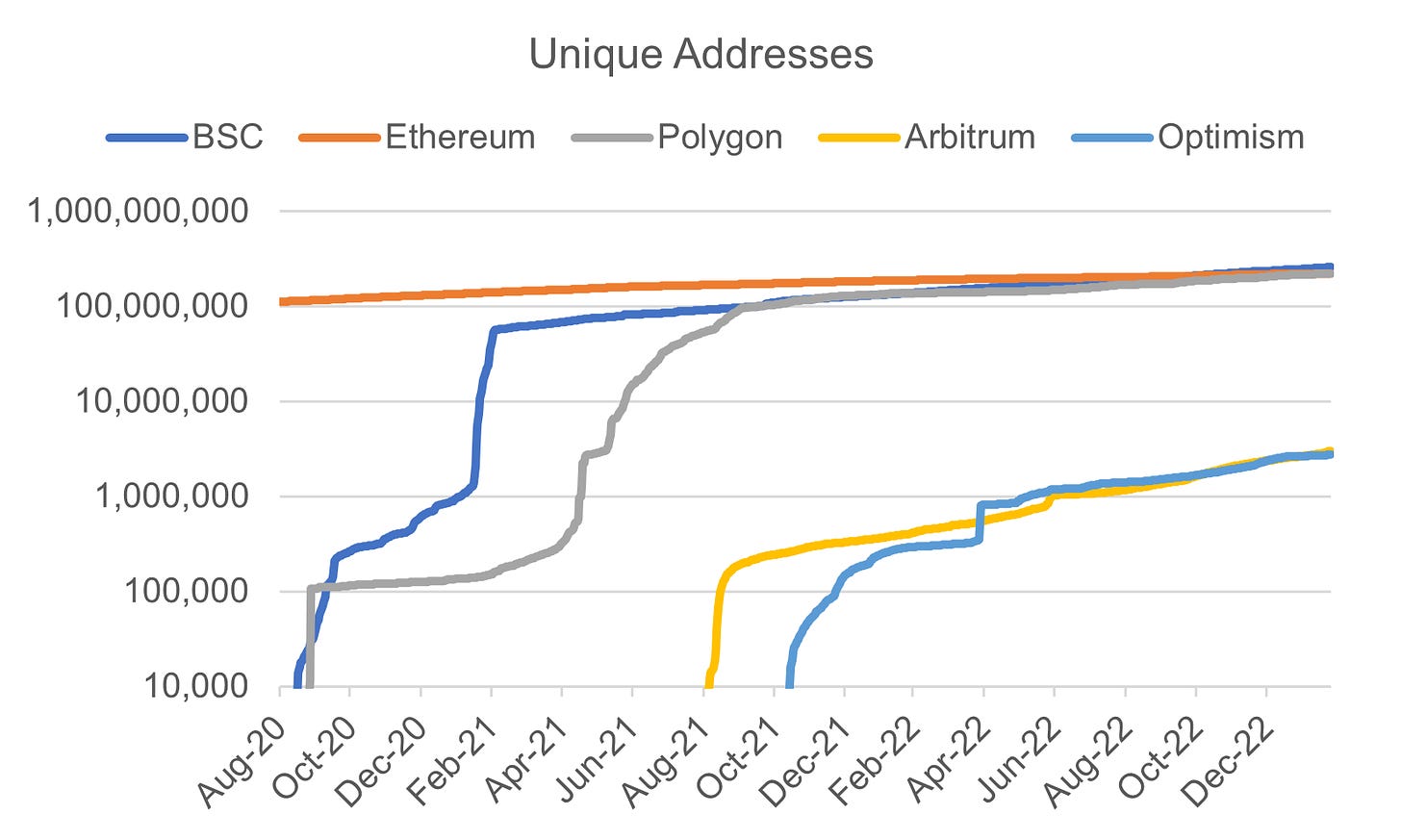

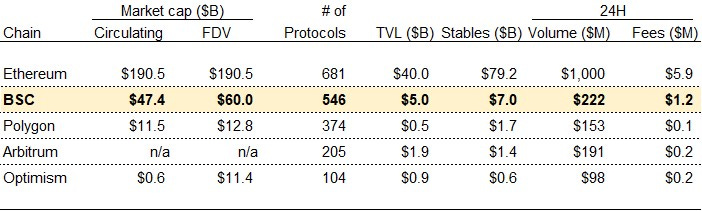

Here’s another curious question: aside from PancakeSwap, can you name a single Decentralized Finance (DeFi) application on the chain? I sure can’t.

This is despite BSC having the second most protocols at 546 after Ethereum’s 681.

BSC is Huge w/ a lot of Protocols but Very Few Have Broken Out

Source: DeFiLlama

Why is that? Aside from being naive Westerners and not knowing better, I speculate the average quality of a BSC protocol is quite… low. BSC is notorious for P&Ds and even to this day BSC’s number one application, PancakeSwap, looks unserious relative to its Ethereum-based peer Uniswap.

BSC’s #1 App - PancakeSwap - Looks Unserious vs. Its Ethereum Peers

So Binance Smart Chain is huge but its application ecosystem is relatively weak. Will it always be that way?

I doubt it.

User and developer activity remains incredibly high well into the crypto bear market. This is highly encouraging and suggests potential for many breakout projects in the years to come.

Binance’s founder certainly seems keen to make it happen:

If anyone could help BSC DeFi continue to grow, it’s CZ.

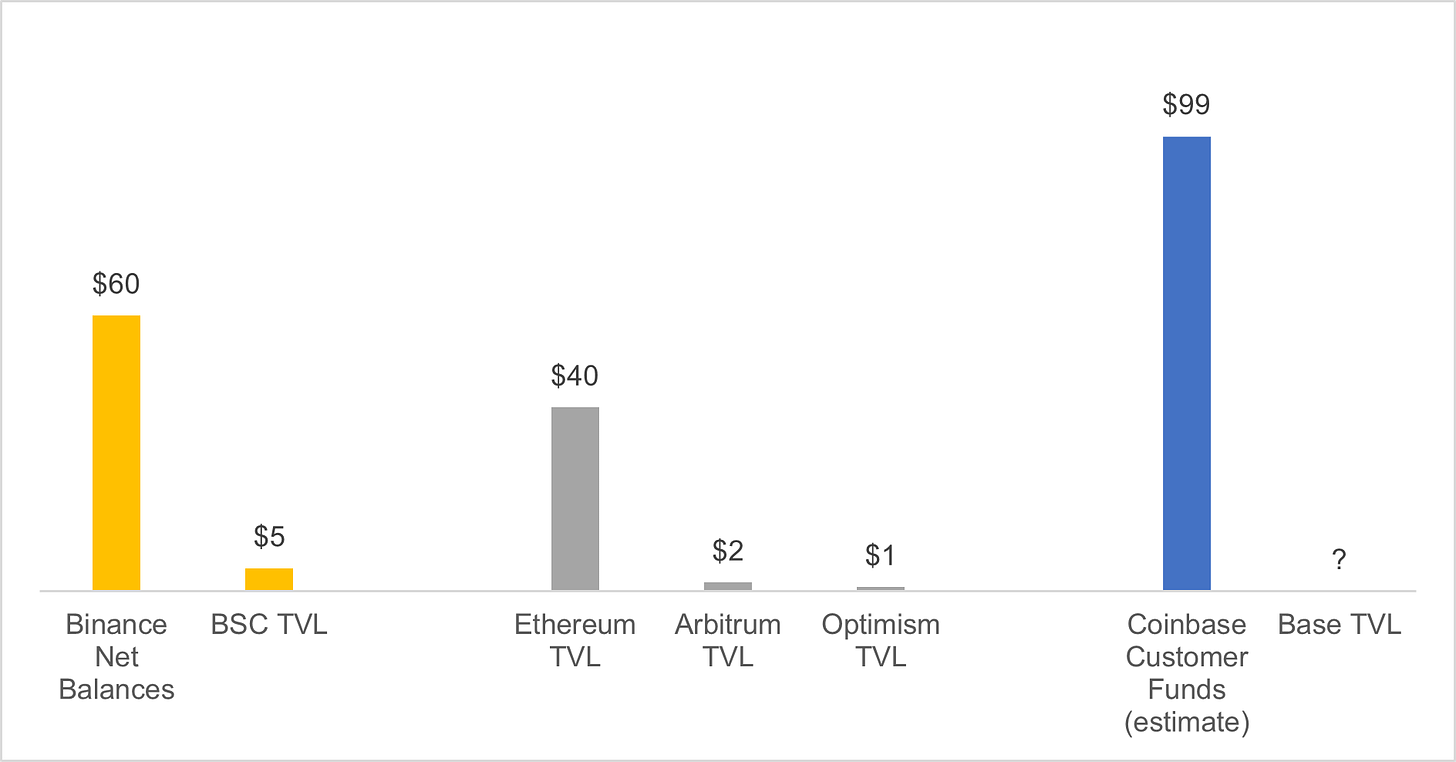

Binance the exchange has roughly $60B / ~5% of the world’s crypto sitting on its platform. In the same way Ethereum L2s Arbitrum and Optimism stand to benefit from the massive capital- and user-base of the Ethereum base layer, BSC will likely be a major beneficiary of the users and capital attracted by the Binance exchange.

(by the way, I expect this to be a major theme w/ Coinbase’s Base L2; Coinbase has >100 million customer accounts and ~10% of the crypto economy’s funds sitting on its platform…)

BSC Ecosystem will Continue to Benefit from Binance’s Huge Presence

Source: Binance Proof of Reserves, DeFiLlama, Coinbase filings

Interesting BSC DeFi Applications: Thena and Level

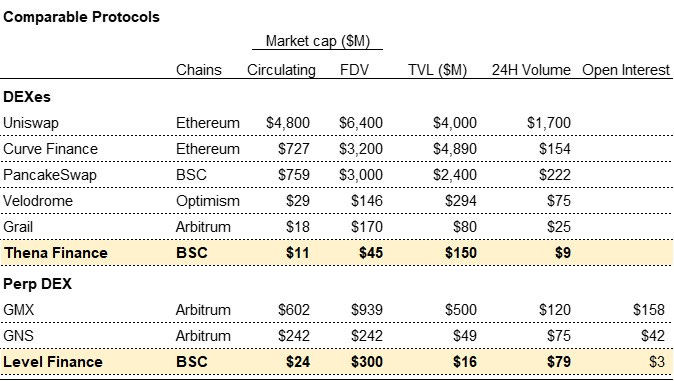

This is not meant to be comprehensive by any means but two BSC applications I find interesting are Thena Finance and Level Finance.

Thena Finance is the leading Solidly Fork on BSC. Despite only launching two months ago, Thena is already the 7th largest protocol on BSC by TVL with $153M locked. The website UI and documentation are very high-quality, a nice contrast to PancakeSwap’s cartoonish feel. Relative to other Solidly forks, Thena’s emissions are modest and locking activity has been strong as exhibited by the token’s recent price action. The market cap also remains low relative to what it could be (see table below).

Level Finance is the leading perp DEX on BSC. Unlike the so many cheap GMX forks out there, Level’s code base was built from the ground up. Most interestingly, the protocol has several novel innovations. These include:

A tranching feature for LPs to be able to opt into their preferred level of risk as a counterparty to the Level platforms traders;

Decentralized access to the protocol’s treasury. Level’s treasury token LGO gives protocol owners direct access to their proportional ownership of the protocol’s treasury (I’ve never seen anything like this; in its final form the protocol could also be the most decentralized application I’ve come across ).

On the negative, thanks to Arthur Hayes and his well-known position in the project, Level is hyped up for what it is today w/ a ~$25M market cap and $300M FDV vs. $3M of OI.

Thena and Level are Two Interesting Early-stage BSC Projects

Source: Coingecko, DeFiLlama and protocol websites. Note Level’s Open Interest figure is a point in time vs. GMX which is cumulative over 24 hours.

Conclusion: Don’t Sleep on This Sleeping Giant

The ingredients for BSC to be a major player in the smart contract space are there: lots of active users, lots of active devs, and support from the most powerful exchange in crypto. With a bit of time, it seems likely that there will be a number of massive applications coming out of this promising ecosystem.